2026 Final Gross Rate Changes - Wisconsin: +22.8%; multiple carriers pulling out of multiple counties

Originally posted 8/11/25

SCROLL DOWN FOR UPDATES

Overall preliminary rate changes via the SERFF database, Wisconsin Insurance Dept. and/or the federal Rate Review database.

Aspirus Arise Health Plan of WI

The average proposed rate increase of 12.6%, effective January 1, 2026 is expected to impact 13,677 members, based on membership as of March 31, 2025. The rate increase varies by plan, ranging between 4.4% and 20.5%. Rate changes vary by plan due to the impact of changes in benefits and rating adjustments to account for the non-funding of Cost Sharing Reduction (CSR) payments.

...Medical and prescription drug trend for these products is anticipated to be an average of 6.9% per year on allowed claims. This was developed based on historical experience, as well as consideration of information available on changes in the cost of services due to general medical and prescription drug inflation and changes in the anticipated utilization of services. For 2026 cost projections, adjustments to 2024 allowed claims consider population changes and costs. This includes factoring in expected disenrollments resulting from the expiration at the end of 2025 of enhanced premium subsidies established in the American Rescue Plan Act. The expiration of these subsidies may lead to higher average statewide morbidity, potentially increasing overall medical costs.

Common Ground Co-Op:

This document contains the Part II written description justifying the rate increase subject to review on Common Ground Healthcare Cooperative’s (CGHC) individual medical block of business, effective January 1, 2026. The average proposed rate increase is 13.3%, while the exact change varies between 5.7% and 55.9%. The exact rate change for a subscriber varies based on age, geographic region, and plan selection. There are 50,092 members enrolled as of March 2025 who are affected by the change. The main drivers of the rate increase are increasing utilization and cost trends across a number of services with trends anticipated to be over 7%. Additionally, the expiration of ARPA expanded subsidies is adding additional expected utilization and an overall change in market acuity.

Chorus Community Health Plan

(Chorus Community is dropping out of the Wisconsin individual market):

Chorus Community Health Plans, the health insurance provider owned by Children's Wisconsin, is dropping out of the Affordable Care Act marketplace.

About 11,000 people in eastern Wisconsin will have to switch to a new health insurance plan during the open-enrollment period for next year. That period begins Nov. 1.

Compcare Health Services (Anthem)

Compcare Health Services Insurance Corporation (Compcare) has made an application to the Wisconsin Office of the Commissioner of Insurance for a rate change of 31.4 percent, excluding the impact of aging, for its ACA-compliant individual health plan products effective January 1, 2026. At the individual plan level, the rate changes range from 9.1 percent to 47.3 percent. This increase will impact approximately 68,700 Wisconsin members renewing in 2026 with Compcare. The actual rate change for a subscriber could be higher or lower depending on the benefit plan selected, geographic location, age characteristics, and dependent coverage.

...The primary driver of the rate increase in the filing is the continued increase in the cost of healthcare. This is driven by increases in the price of services, or unit costs, primarily from hospitals, physicians and pharmaceutical companies, coupled with increases in the consumption of services, or utilization, by members. Increases in the unit costs of services are driven by technology advances, general inflationary pressures, and a variety of other factors. Changes in utilization of services can be driven by the aging of the population, benefit design and many other factors.

Dean Health Plan, Inc

Dean Health Plan (DHP) is requesting rate change for its individual market business in Wisconsin. The rate change will take effect on January 1, 2026 and will impact an estimated 31,087 members. The average rate change will be 13.14% by product and will result in rate changes that vary across plan designs.

Group Health Cooperative of SC WI

(Group Health's actuarial memo is heavily redacted)

HealthPartners Insurance Co

This filing provides 2026 proposed rates for Individual ACA plans offered by HealthPartners Insurance Company (HPIC) in the State of Wisconsin. The rates contained within this filing will be effective January 1, 2026 through December 31, 2026 for all plans.

This actuarial memorandum is intended to demonstrate that the premiums for these plans are not excessive in relation to the benefits provided and to demonstrate compliance with state and federal requirements and restrictions on rating factors and actuarial pricing values. This rate filing is not intended to be used for other purposes.

Medica Community Health Plan

Medica Community Health Plan (Medica) is requesting a rate change for its individual market business in Wisconsin. The rate change will take effect on January 1, 2026 and will impact an estimated 15,733 members. The average rate change will be 12.6% and will result in rate changes that vary across plan designs. This includes changes to the costs of care.

MercyCare HMO

(MercyCare's actuarial memo is heavily redacted)

Molina Healthcare of WI

1. Scope and range of the rate increase: Molina’s proposed rates represent an average rate change of 20.6% for the 1 Molina members enrolled in continuing plans effective March 2025. The proposed rate changes vary by metal tier. Members would receive premium changes ranging from 20.6% to 20.6% depending on their plan, geographic location, and age.

(yes, that's right: Molina only has 1 person enrolled in their Wisconsin individual market policies)

Network Health Plan

(Network Health's actuarial memo is heavily redacted)

Quartz Health Benefit Plans Corp

Quartz Health Plan Benefits Corporation (Quartz) is requesting an average rate increase of 16.88%. Quartz members would receive premium increases ranging from 1.33% to 43.77%, depending on their plan selection. As of March 2025, there are 17,338 individuals that will be impacted by this increase. Additionally, premium rates may change for individual contracts by an amount outside of the filed rates due to changes occurring at the contract level. These contract level changes may include changes in various characteristics, such as age, benefit plan, and tobacco user status.

Security Health Plan of WI

Security Health Plan of Wisconsin, Inc. (SHP) has requested an average rate increase of 24.33% on its Individual Select product, 23.87% on its Individual SimplyOne product, 26.84% on its Individual Enrich product, and an average rate increase of 25.45% on its Individual Premier product with effective dates of January 1, 2026. Rate increases vary by plan and geographic region, ranging from 9.77% to 36.86%. As of March 2025 there are approximately 25,987 individual members on these plans. Most of the members are eligible for a premium subsidy and may not experience a post-subsidy rate change within this range.

...Deductible levels and other member cost-sharing provisions have been changed for some plans in order to maintain compliance with the federal 2026 Revised Actuarial Value Calculator.

UnitedHealthcare of WI

UHC is filing 2026 rates for individual products. The proposed rate change is 34.51% and will affect 31,129 individuals. The rate changes vary between 29.28% and 37.47%. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

...There are many different healthcare cost trends that contribute to increases in the overall U.S. healthcare spending each year. These trend factors affect health insurance premiums, which can mean a premium rate increase to cover costs. Some of the key healthcare cost trends that have affected this year’s rate actions include:

- Increasing cost of medical services: Annual increases in reimbursement rates to healthcare providers, such as hospitals, doctors, and pharmaceutical companies.

- Increased utilization: The number of office visits and other services continues to grow. In addition, total healthcare spending will vary by the intensity of care and use of different types of health services. The price of care can be affected using expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher costs from deductible leveraging: Healthcare costs continue to rise every year. If deductibles and copayments remain the same, a higher percentage of healthcare costs need to be covered by health insurance premiums each year.

- Impact of new technology: Improvements to medical technology and clinical practice often result in the use of more expensive services, leading to increased healthcare spending and utilization.

- Non-claims expenses: The fee charged to offer plans on the Exchange increased from 2025 to 2026.

- Expiration of enhanced premium tax credits: Expanded and enhanced federal premium tax credits for consumers will expire at the end of 2025. As a result, post-tax credit premiums will increase for calendar year 2026.

- Changes in market morbidity: Premiums reflect the expected increase in the average cost per member due to healthier members leaving the market if enhanced ATPCs are allowed to expire.

WI Physicians Service (WPS)

(WPS's actuarial memo is heavily redacted)

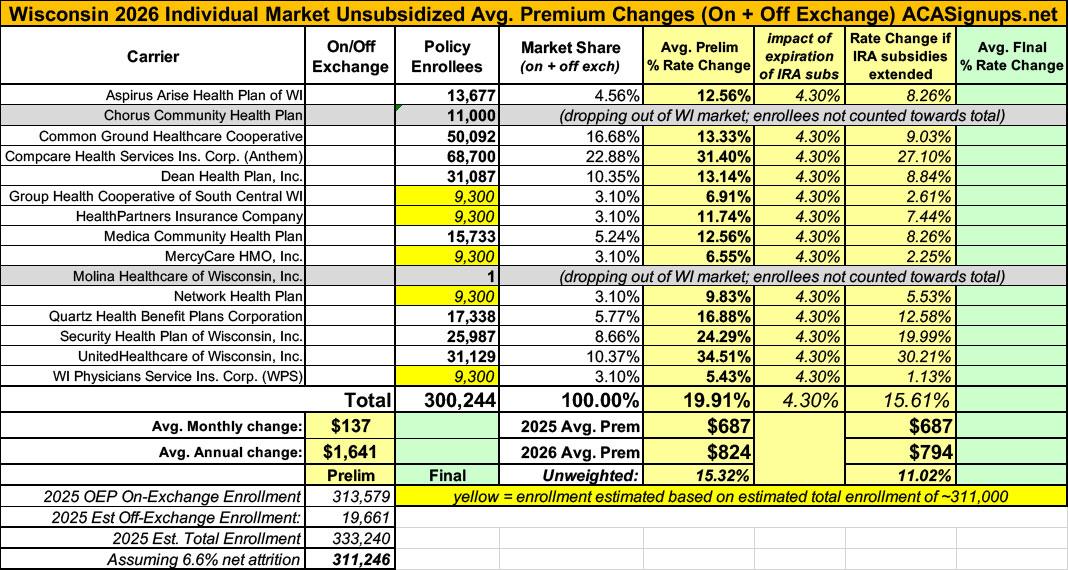

As noted above, five carriers have heavily redacted their actuarial memos, making it impossible for me to know how many enrollees they currently have, which in turn means I have to use rough estimates.

Wisconsin had 313,579 people enroll during the 2025 OEP, and based on the 2024 CMS liability risk score report, there should be another ~19,000 or so off-exchange enrollees, for a total of roughly 333,000. CMS also reported a national net attrition rate of 6.6% thru April; applying that gives a net total of roughly 311,000.

There's around ~265,000 accounted for across the other 10 carriers, leaving around ~46,000 unaccounted for. If I assume equal enrollment across all 5 remaining carriers, that gives a semi-weighted average rate hike of 19.9%.

HOWEVER, It's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

UPDATE 10/20/25: Thanks to Louise Norris for calling my attention to this post at Agility Health Services noting that Molina Healthcare is apparently pulling out of the entire state, which makes sense given that their filing says that they only have one person enrolled statewide at the moment anyway:

Meanwhile, I have no enrollment data at all for most of the small group carriers; the unweighted average 2026 rate hike there is around 10.9%.

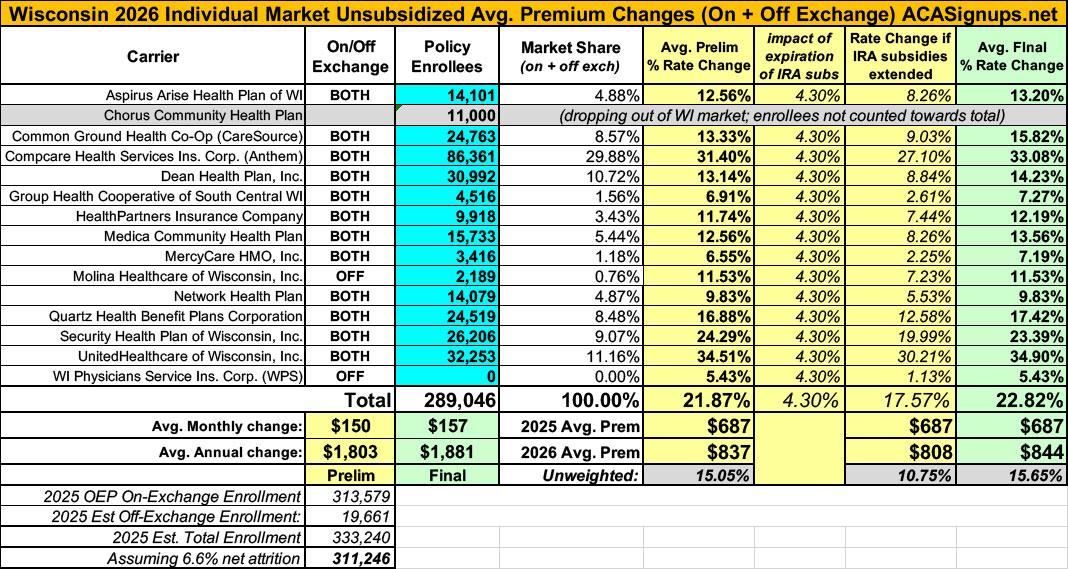

UPDATE 10/28/25: With just 4 days to go before the launch of the 2026 Open Enrollment Period, the Wisconsin Insurance Dept. has published final, approved rate filing decisions for the individual market.

Overall, the weighted average increase has inched up several points to 22.8%, due partly to the actual filing decisions but also to revised enrollment numbers for some carriers.

In addition, the WI DOI specifies which counties each of the carriers is either pulling out of or expanding into:

Common Ground Health Co-Op (CareSource): Leaving Calumet, Dodge, Fond du Lac, Kenosha, Milwaukee, Outagamie, Racine, Sheboygan, Waupaca, Waushara & Winnebago Counties.

Compcare Health Services (Anthem): Leaving Columbia, Dane, Green, Iron, Langlade, Price, Rock, Taylor, Vilas & Walworth Counties.

Dean Health Plan: Leaving Manitowoc County

Group Health Co-Op: Leaving Adams, Grant, Iowa, Juneau & Lafayette Counties

Molina: Leaving all counties except Jefferson

Network Health Plan: Expanding into Waupaca & Waushara Counties

Quartz Health Benefit Plans: Leaving Adams, Brown, Calumet, Florence, Grant, Green Lake, Iowa, Jefferson, Juneau, Kenosha, Kewaunee, Lafayette, Manitowoc, Marinette, Marquette, Milwaukee, Oconto, Outagamie, Ozaukee, Racine, Richland, Rock, Sauk, Shawano, Sheboygan, Walworth, Washington, Waukesha, Waushara and Winnebago Counties

With all of these final changes, here's what the overall Wisconsin market looks like: