2026 (NOT) Final Gross Rate Changes - Ohio: +19.8% (updated)

Originally posted 8/08/25

Overall preliminary rate changes via the SERFF database, Ohio Insurance Dept. and/or the federal Rate Review database.

Aetna Health:

(Aetna/CVS is pulling out of the ACA individual market in every state; I've made an educated guess as to their current enrollees, who aren't counted as part of the weighted average as they'll have to shop around for a new carrier this fall. See below.)

Antidote Health Plan:

(Antidote's actuarial memo is heavily redacted so I don't know their current enrollment; I've had to make an educated guess. See below.)

AultCare Insurance:

(AultCare is pulling out of the ACA individual market in every state; I've made an educated guess as to their current enrollees, who aren't counted as part of the weighted average as they'll have to shop around for a new carrier this fall. See below.)

Buckeye Community/Ambetter:

The proposed rate change of 27.3% applies to approximately 117,251 individuals. Buckeye Community Health Plan’s projected administrative expenses for 2026 are $78.67 PMPM. Administrative expense does not include $31.43 for taxes and fees. The historical administrative expenses for 2025 were $72.57 PMPM, which excludes taxes and fees. The projected loss ratio is 84.2% which satisfies the federal minimum loss ratio requirement of 80.0%.

Buckeye Health Plan Solutions:

The proposed rate change of 25.3% applies to approximately 4,283 individuals. Buckeye Health Plan Community Solutions, Inc.’s projected administrative expenses for 2026 are $74.13 PMPM. Administrative expense does not include $9.54 for taxes and fees. The historical administrative expenses for 2025 were $75.71 PMPM, which excludes taxes and fees. The projected loss ratio is 87.5% which satisfies the federal minimum loss ratio requirement of 80.0%.

CareSource Ohio:

This document contains the Part II written description justifying the rate increase subject to review on CareSource’s (CAS) individual medical block of business in Ohio, effective January 1, 2026. The average proposed rate increase is 17.2% and varies based on age, geographic region, and plan selection. There are 46,541 members currently enrolled that will be affected by the rate change. CAS has historically been profitable in this market, however costs for services and the number of services for both medical and pharmacy benefits have increased significantly and is the major contributor to this rate action. Changes in benefits are not a major contributor to the rate action and are within the bounds defined by CMS’ Final AV Calculator instructions. The expiration of ARPA and the resulting assumed reduction in total marketplace membership is a driver of increased administrative expenses in this filing.

Community Insurance Co:

Community Insurance Company (also referred to as Anthem) has made an application to the Ohio Department of Insurance for premium rate changes for its fully ACA-compliant individual health plan products. This increase will impact approximately 100,000 Ohio insured members renewing in 2026 with Anthem. At the individual plan level, rate increases range from 14.40% to 31.57%. An individual’s actual rate could be higher or lower depending on the geographic location, age characteristics, dependent coverage and other factors.

Anthem expects the proposed rate increase will cover projected medical trends and yield a medical loss ratio of 86.48%, meaning more than eighty-six cents of each premium dollar are expected to go to covering our members’ medical expenses and improving health care quality. This projected MLR of 86.48% exceeds the minimum MLR requirement of 80% as defined in the Affordable Care Act (ACA). In the event Anthem’s MLR is less than the Federal required minimum for a three year period, Anthem will refund the difference to policyholders, consistent with federal regulations.

The primary drivers of premium increases are associated with increased cost of benefit expense for this ACA compliant block. Increased cost of benefit expense is driven by increases in the price of services primarily from hospitals, physicians and pharmacies, coupled with members increasing their use of health care services, also called “utilization”. Increases in the price of services are driven by technological advances, new specialty medications, and a variety of other factors. Increased utilization is driven by member level utilization and selection patterns in the Guaranteed Issue, Community Rated ACA market.

Anthem is committed to working to hold down the cost of insurance and price the Individual ACA market for long term sustainability. We continue to explore innovative collaboration with providers and negotiate deeper discounts at our hospitals. We provide members with tools to make informed decisions about where and how to receive treatment. Despite these efforts to moderate the cost of insurance, the cost of benefit expense in the Individual ACA market has continued to rise. In light of emerging costs, 2026 premium increases are needed to price Anthem’s ACA-compliant Individual health plan products for long term sustainability.

Medical Health Insuraing Co:

For Individual ACA plans effective January 1, 2026, MHICO is proposing an overall average increase of 13.2% for existing plans, potentially impacting up to 60,084 members. This rate increase is based on actuarial projections, and results may differ from these projections as actual experience deviates from the rating assumptions.

Items impacting the proposed rate increase include:

- Increase in medical and drug costs are projected at 5.3% annually

- Changes in demographics and morbidity of the risk pool

- An increase in MHICO’s projected risk adjustment transfer payment

- The profit and risk is projected to increase $0.40 PMPM. The taxes and fees are projected to increase $6.49 PMPM.

The projected loss ratio is 83.4%, which satisfies the federal minimum loss ratio requirement of 80.0%.

Molina Healthcare:

Molina Healthcare of Ohio, Inc. is a managed care organization that provides healthcare services for individuals eligible for Medicaid, Medicare, and Marketplace throughout the State of Ohio. Molina is a licensed state health plan managed by its parent corporation, Molina Healthcare, Inc.

1. Scope and range of the rate increase: Molina’s proposed rates represent an average rate increase of 20.0% for the 90,395 Molina members enrolled in continuing plans effective April 2025. The proposed rate changes vary by metal tier. Members would receive premium changes of approximately 8.9% to 29.9% depending on their geographic location, metal tier, and age.

2. Financial experience of the product: The proposed premium rates yield a medical loss ratio of 82.8%. The medical loss ratio represents the percentage of every premium dollar that Molina expects to spend on medical expenses and improving health care quality for our members. The projected medical loss ratio of 82.8% exceeds the Affordable Care Act minimum required loss ratio of 80.0%.

3. Changes in Medical Service Costs: Medical inflation related to the utilization and cost of covered services increased claims by 6.9%. Trend is one of the primary contributors to an increase in rates. Changes in provider contracting rates also contributes to the regional rate changes.

4. Changes in Benefits: In 2026, Molina is renewing ten Gold, Silver and Bronze plan offerings from 2025. The impact on rates from benefit design changes for all renewal plans is minimal.

5. Administrative Costs and Anticipated Margins: Total administrative expenses are expected to contribute toward 15.4% of premium, remaining the same as 2025. The exchange fee is expected to increase. The targeted profit margin remains 3.0% of premium.

6. Program Changes: The expiration of the enhanced premium tax credits (eAPTCs), Program Integrity and overall economic uncertainty will lead to people leaving the Marketplace, which a higher skew of healthy leaving and therefore driving up acuity in the risk pool.

Oscar Buckeye:

1. Scope and Range of Rate Increase

The purpose of this document is to present rate change justification for Oscar Buckeye State Insurance Corporation (Oscar’s) Individual Affordable Care Act (ACA) products, with an effective date of January 1, 2026, and to comply with the requirements of Section 2794 of the Public Health Service Act as added by Section 1003 of the Patient Protection and Affordable Care Act (ACA).

Using in-force business as of May 2025, the proposed average rate increase for renewing plans is 12.7%. Rate increases vary by plan due to a combination of factors including shifts in benefit leveraging and cost-sharing modifications. This rate increase is absent of rate changes due to attained age. The rate increase impacts an estimated 64,412 members.

2. Reason for Rate Increase(s)

The significant factors driving the proposed rate change include the following:

Medical and Prescription Drug Inflation and Utilization Trends

The projected premium rates reflect the most recent emerging experience which was trended for anticipated changes due to medical and prescription drug inflation and utilization.

Administrative Expenses, Taxes and Fees, and Risk Margin

Changes to the overall premium level are needed because of required changes in federal and state taxes and fees. In addition, there are anticipated changes in both administrative expenses and targeted risk margin.

Prospective Benefit Changes

Plan benefits have been revised as a result of changes in the Center for Medicare and Medicaid Services (CMS) Actuarial Value Calculator and state requirements, as well as for strategic product considerations.

Anticipated Changes in the Average Morbidity of the Covered Population

Changes to the overall premium level are needed because of anticipated changes in the underlying morbidity of the projected marketplace.

Anticipated Changes in the Network Configuration

Changes to the overall premium level are needed because of anticipated changes in the underlying network configuration and associated unit costs.

Oscar Insurance Corp:

1. Scope and Range of Rate Increase

The purpose of this document is to present rate change justification for Oscar Insurance Corporation of Ohio (Oscar’s) Individual Affordable Care Act (ACA) products, with an effective date of January 1, 2026, and to comply with the requirements of Section 2794 of the Public Health Service Act as added by Section 1003 of the Patient Protection and Affordable Care Act (ACA).

Using in-force business as of May 2025, the proposed average rate increase for renewing plans is 17.6%. Rate increases vary by plan due to a combination of factors including shifts in benefit leveraging and cost-sharing modifications. This rate increase is absent of rate changes due to attained age. The rate increase impacts an estimated 9,294 members.

2. Reason for Rate Increase(s)

The significant factors driving the proposed rate change include the following:

Medical and Prescription Drug Infl ation and Utilization Trends

The projected premium rates reflect the most recent emerging experience which was trended for anticipated changes due to medical and prescription drug inflation and utilization.

Administrative Expenses, Taxes and Fees, and Risk Margin

Changes to the overall premium level are needed because of required changes in federal and state taxes and fees. In addition, there are anticipated changes in both administrative expenses and targeted risk margin.

Prospective Benefit Changes

Plan benefits have been revised as a result of changes in the Center for Medicare and Medicaid Services (CMS) Actuarial Value Calculator and state requirements, as well as for strategic product considerations.

Anticipated Changes in the Average Morbidity of the Covered Population

Changes to the overall premium level are needed because of anticipated changes in the underlying morbidity of the projected marketplace.

Anticipated Changes in the Network Configuration

Changes to the overall premium level are needed because of anticipated changes in the underlying networkconfiguration and associated unit costs.

Paramount:

Part II Written Description Justifying the Rate Increase

For Individual ACA plans effective January 1, 2026, Paramount is proposing an overall average increase of 36.63% for existing plans, potentially impacting up to 2,263 total members. This rate increase is based on actuarial projections, and results may differ from these projections as actual experience deviates from the rating assumptions.

Items impacting the proposed rate increase include:

- 6.3% in experience period claim costs

- Changes in demographics and morbidity of the risk pool

- An increase in Paramount’s projected risk adjustment transfer payment

- Changes in the negotiated contracts between Paramount and providers.

The projected loss ratio is 86.0%, which satisfies the federal minimum loss ratio requirement of 80.0%.

Summa:

Qualified Health Plan Issuers are requested to post a justification for a rate increase. Below is justification for the rate increase effective January 1, 2026 for Summa Insurance Company (SummaCare). The SummaCare products include Gold, Silver, Bronze, and Catastrophic plans. In total, SummaCare is filing eighteen plans on-Exchange and twenty-one plans off-Exchange. These plans will be offered in rating areas 12 and 15. Plan designs include 2026 state mandated benefits, as well as services which exceed the Essential Health Benefits for select plans. This filing includes HMO products.

The average rate change for individuals renewing in 2026 is 12.0%, with the minimum and maximum rate changes equal to 9.1% and 18.6%, respectively. The proposed rate changes vary by plan dude to changes in the paid to allowed ratios, and the application of administrative costs on a fixed fee basis rather than a variable cost basis. The rate change is estimated to impact approximately 6,409 members.

The primary drivers of the rate change are summarized below:

- Medical and prescription drug trends

- Updated experience using calendar year 2024 allowed claims

- Updates to the projected risk transfer

- Morbidity increases due to policy changes, such as the expiration of enhanced premium tax credits

The Health Plan of WV:

The experience reported on Worksheet 1, Section I of the URRT shows THP's earned premium, incurred and paid claims, and enrollment for the period of January 1, 2024 through December 31, 2024, with claims paid through April 30, 2025. Current enrollment and current premium on Worksheet 2, Section II are reported as of April 30, 2025. There are currently 27 policyholders and 38 covered lives for this block of business.

UnitedHealthcare of OH:

The overall average rate change is 30.3%. The rate change by plan varies from 19.8% to 39.9%.

There are 25,675 individuals impacted as of April 30, 2025.

The premium collected between January 1st, 2024 and December 31st, 2024 was $193,212,914. Incurred claims during this period were $123,205,793 and UHCOH is estimated to pay $17,130,450 into the risk adjustment program. The loss ratio, or portion of premium required to pay medical claims, for this time period is 72.6%.

Key Drivers of Change in Medical Service Costs

- Increasing Cost of Medical Services: Annual increases in reimbursement rates to health care providers – such as hospitals, doctors, and pharmaceutical companies.

- Increased Utilization: The number of office visits and other services continues to grow. In addition, total health care spending will vary by the intensity of care and use of different types of health services. The price of care can be affected by the use of

- expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher Costs from Deductible and Maximum out of Pocket (MOOP) Leveraging: While health care costs continue to rise every year, if deductibles and copayments remain the same, a greater percentage of health care costs need to be covered by health insurance premiums each year.

- Impact of New Technology: Improvements to medical technology, clinical practice, and new prescription drugs require use of more expensive services - leading to increased health care spending and utilization.

- Demographics: Change in the projected age, gender, and metal mix of the underlying population can change the medical claims expected to be incurred.

- Regulatory Changes: The expiration of enhanced premium subsidies passed under the American Rescue Plan Act (ARP) as well as the CMS 2025 Marketplace Integrity and Affordability Final Rule are expected to lead to higher costs as healthier enrollees exit the market.

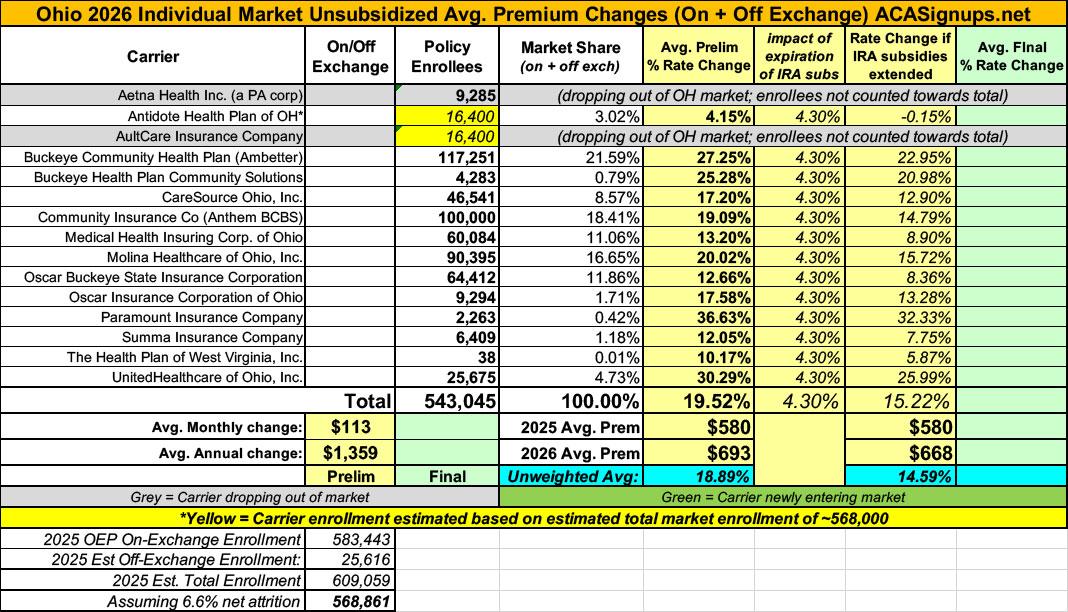

As noted above, two carriers (Aetna and AultCare) are dropping out of the OH market, and a third (Antidote) has redacted their current enrollment. In order to run a weighted average rate hike, therefore, I have to make estimates based on the total market enrollment.

Ohio's total 2025 OEP enrollment was ~583,000 people, and using 2024 CMS liability risk score data, I estimate another ~26,000 off-exchange enrollees, or ~609,000 total.

If so, that would leave ~82,200 enrollees unaccounted for. If I assume these are equally divided across the 3 "missing" carriers that's ~27,400 apiece...except that 2 of those carriers aren't counted as part of the weighted average.

Using these assumptions gives a weighted average unsubsidized premium increase of ~19.2%.

It's important to remember, however, that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

UPDATE 8/14/25: I've acquired Aetna's withdrawal notice which includes their actual enrollment total while also reducing my estimate of the total market enrollment. The combined result is that the weighted total average is bumped up slightly to 19.5%.

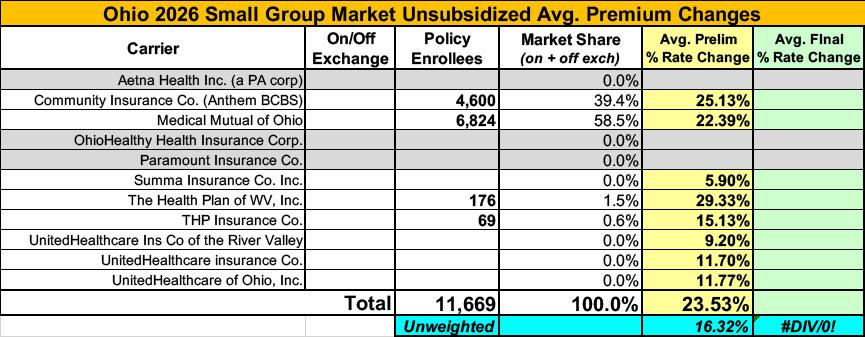

Meanwhile, I have no enrollment data at all for most of the small group carriers; the unweighted average 2026 rate hike there is around 16.3%

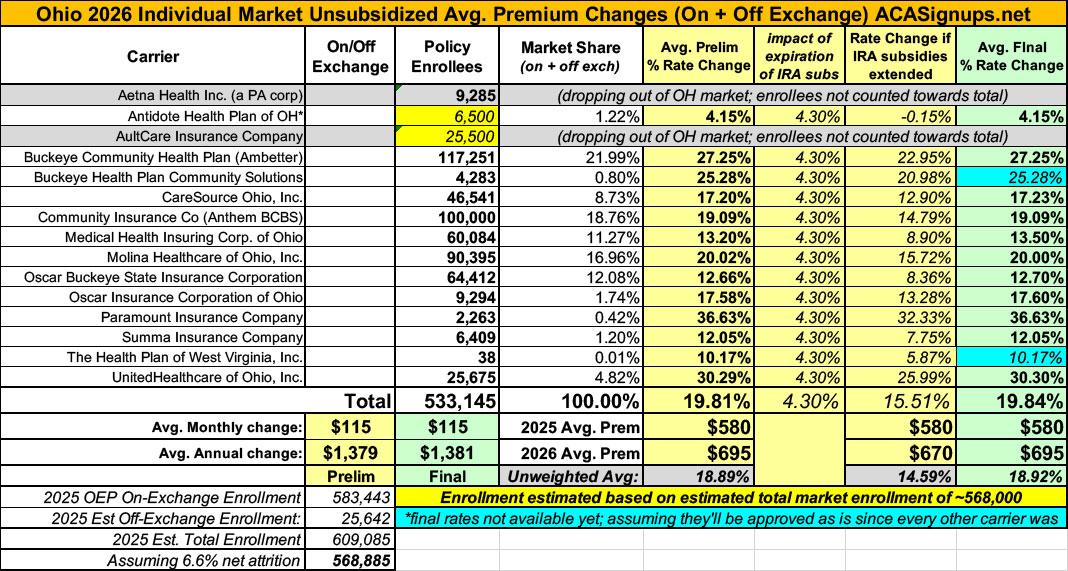

UPDATE 8/29/25: 10 out of 12 carriers have published their final/approved rate filings. All of them have been approved pretty much exactly as is. The other two are missing but make up less than 1% of the total market anyway, so the needle would barely move even if they both had dramatic changes. As a result I'm going with a weighted average rate increase of...19.8%, the same as it was to begin with.

I was able to get a better fix on Antidote's enrollment, however, based on their policyholder figure.

UPDATE 9/19/25: Welp. Sure enough, as I predicted earlier this week, it looks like Ohio carriers have scrapped their supposedly "final" 2026 rate filings and have to make some adjustments after all...all of the filings which were listed as APPROVED a few weeks ago now read WITHDRAWN.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.