Minnesota: MNsure wraps up 2026 Open Enrollment w/139K QHPs, down 8.1% y/y; 50% increase in cancellations, 112% increase in "buying down"

MNsure, Minnesota's state-based ACA exchange, has posted their January Board Directors Meeting presentation, which includes the final 2026 Open Enrollment Period tally along with a bunch of other data points of interest:

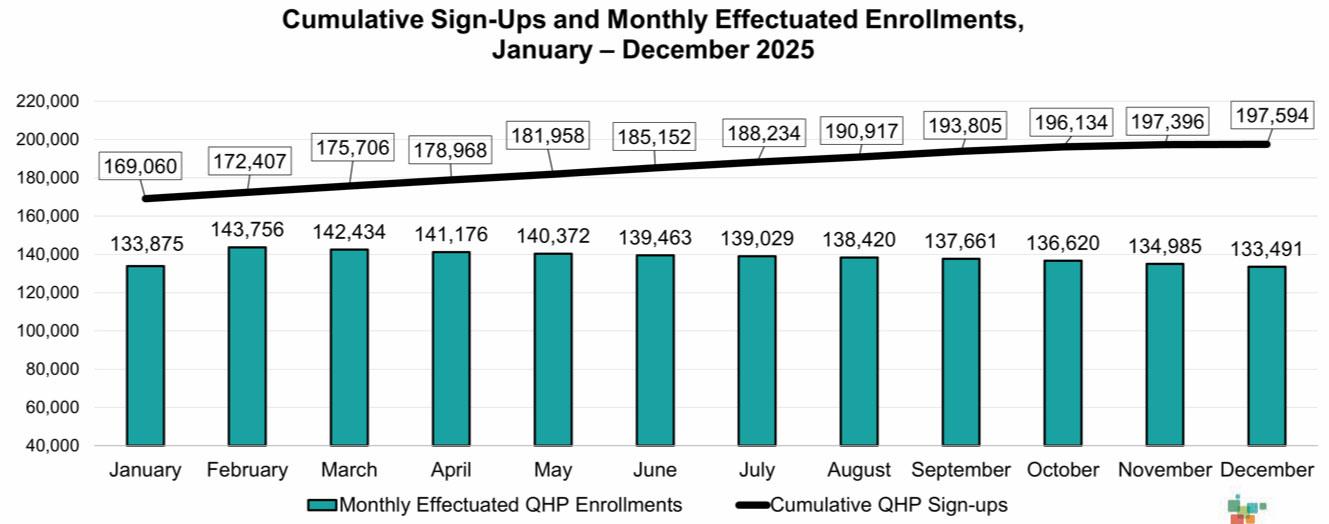

Plan Year 2025 (November 1, 2024 – December 31, 2025)

- Total (Medical Assistance, MinnesotaCare, QHP) 357,227

- Medical Assistance Applicants 141,897

- MinnesotaCare Applicants 17,736

- Qualified Health Plan (QHP) Sign-ups 197,594

- QHP New Consumers 74,423

- Qualified Dental Plan Sign-ups 59,575

Financial Assistance Type Individuals

- Percentage with Advanced Premium Tax Credit (APTC): 62.3%

- Percentage with Cost-Sharing Reductions: 9.6%

- December Average Monthly APTC: $360.15

- Cumulative APTC for Households Receiving APTC: $376,892,297

The reason Minnesota has such a small percent of their ACA exchange enrollees receiving either APTC (over 92% nationally last year) or CSR assistance (over 50% nationally) is because of MinnesotaCare, their Basic Health Plan program for residents who earn between 138 - 200% of the Federal Poverty Level (FPL).

This also means that Minnesota's trendlines/demographics can't really be applied to the country at large, since 65% of all ACA enrollees nationally earn less than 200% FPL.

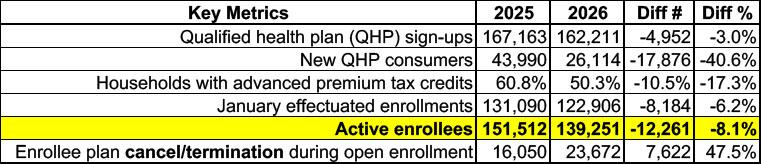

Plan Year 2026 (November 1, 2025 – January 15, 2026)

- Total (Medical Assistance, MinnesotaCare, QHP) 201,268

- Medical Assistance Applicants 32,063

- MinnesotaCare Applicants 6,994

- Qualified Health Plan (QHP) Sign-ups 162,211

- QHP New Consumers 26,114

- Qualified Dental Plan Sign-ups 50,736

Financial Assistance Type Individuals Households

- Percentage with Advanced Premium Tax Credit (APTC) 49.5%

- Percentage with Cost-Sharing Reductions 8.5%

- Average Monthly APTC $391.32

- Estimated January APTC for Households Receiving APTC: $25,435,059

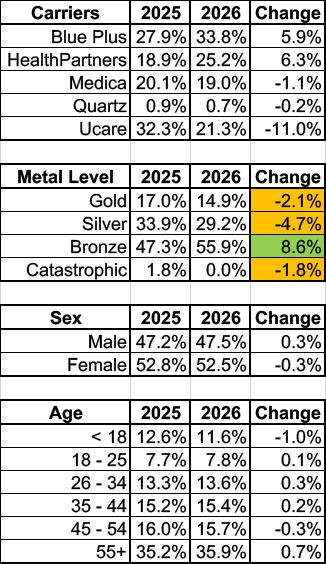

- 87% increase in number of enrollees who switched plans

- 52% of enrollees kept their metal level (bronze, silver, gold)

- 112% increase in consumers “buying down”

- 15% of enrollees canceled or terminated their coverage during OEP (up from 10% last year)

Older enrollees (age 55+) made the most changes:

- 21% changed plans

- 80% of enrollees who changed, went with a lower premium plan

- Younger enrollees (ages 18 – 34) had highest rates of disenrollment

UPDATE 2/10/26: Press release from MNsure (via email; no link yet):

More Minnesotans look to MNsure for help as Congress cuts savings

ST. PAUL, Minn. — More Minnesotans turned to MNsure for help finding private health insurance plans, even though fewer enrolled in those plans due to the loss of enhanced tax credits and resulting higher premiums.

Enrollment in private health insurance plans fell by 8% during MNsure’s recent annual open enrollment period. At the end of open enrollment on January 15, there were 139,251 Minnesotans enrolled in 2026 coverage through MNsure compared to 151,512 last year.

“MNsure worked hard to help Minnesotans find affordable coverage this year,” said MNsure CEO Libby Caulum, “but because Congress allowed the enhanced savings to expire, we heard from many consumers who felt priced out of the marketplace.”

MNsure logged 162,211 private health plan “sign-ups," a 3% drop from last year, which includes passively enrolled consumers and those who terminated or canceled their plans. Final figures are likely to change over the spring as consumers confirm their coverage as first premiums come due.

Consumers searched for cheaper options

A record-setting number of Minnesotans contacted MNsure to navigate the changes in premiums. Calls to MNsure’s help line topped 165,000 — an increase of more than 29% over last year. Traffic to MNsure.org was record-setting with big increases in clicks on links to learn more about “Financial Help” and how to connect to free help from a MNsure-certified assister.

Consumers also reached out to MNsure’s certified assisters, brokers, and navigators for help to find cheaper options in the face of rising premiums. MNsure saw an 87% increase in the number of enrollees who switched health insurance plans this year. Most of those who made a change went with a lower-cost option.

“Minnesotans deserve the peace of mind that comes with having health insurance,” Caulum said. “I am extraordinarily proud of our work, together with our broker, navigator, and certified application counselor partners, to help as many Minnesotans as possible find a coverage option that works for them this year.”

Minnesotans who don’t have health insurance and missed the January 15 deadline to enroll in 2026 coverage may still have opportunities to get covered. Minnesotans who experience a major life event (such as getting married, having a baby, or losing employer-sponsored insurance) may be eligible to shop for coverage through MNsure outside of the open enrollment period.

The January 15 deadline did not apply to residents who qualify for Medical Assistance or MinnesotaCare, or members of federally recognized tribes, who can enroll in health insurance through MNsure any time of year.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.