2026 Final Gross Rate Changes - Virginia: +21.6% (updated)

Originally posted on 8/10/25

Overall preliminary rate changes via the SERFF database, Virginia Bureau of Insurance and/or the federal Rate Review database.

Aetna Health:

(Aetna/CVS is dropping out of the entire individual market nationally in response to Congressional Republicans allowing the upgraded ACA subsidies to expire):

...This letter is formal notice that Aetna Health Inc. (“AHI”) intends to exit from the Individual health insurance market in Virginia effective January 1, 2026. Subject to the Department’s review, we will mail the 180-day notices of discontinuance to covered individuals.

As of May 2025, our records show that AHI has 9,810 subscribers and 13,721 total members in Virginia.

Anthem Health Plans of VA:

Anthem Health Plans of Virginia has made an application to the Virginia Bureau of Insurance for premium rate changes for its fully ACA-compliant individual health plan products. This filing includes an average rate increase of 23.1%, excluding the impact of aging, effective January 1, 2026. The range by plan is between 20.9% and 23.4%. This increase will impact approximately 3,500 Virginia members renewing in 2026 with Anthem. We expect all of the members will receive an increase greater than 15%.

A subscriber’s actual rate could be higher or lower depending on geographic location, age characteristics, dependent coverage, and other factors.

...Drivers of Rate Increase

The primary driver of this increase is the sunsetting of enhanced advanced premium tax credits at the end of 2025. Elimination of the enhanced subsidies is anticipated to result in a decrease of healthy membership and higher morbidity in the remaining ACA population. Additional causes are associated with increases in the price of services primarily from hospitals, physicians and pharmacies, coupled with our members increasing their use of health care services, also called “utilization.” Increases in the price of services are driven by technology advances, new medications, and a variety of other factors.

CareFirst BlueChoice:

CareFirst BlueChoice, Inc. - VA is requesting an average base rate change of 19.8% to our BlueChoice single risk pool. As of 2-28-2025, there are 8,049 members currently enrolled in a BlueChoice product, across all plans, who will be impacted by the rate change.

The main drivers supporting the rate change are 1) decrease in the base period claims experience, 2) trend, 3) higher projected reinsurance factor, and 4) adjustments to membership, morbidity, and risk adjustment due to the anticipated expiration of federal enhanced premium tax credit subsidies on 12/31/2025.

Cigna Health & Life:

Cigna estimates that 45,639 customers will be impacted by this rate increase. On average, customers will see an increase of 22.3%, excluding the impact of aging, with a range of increases from 17.8% to 25.4%. In addition to the factors described below, each customer’s rate increase depends on factors such as where they live and what plan they are enrolled in.

The most significant factors causing the rate increase are:

- Expiration of APTC Subsidies: This rate filing assumes that APTC subsidies will expire on 12/31/2025. The conclusion of the enhanced subsidies is expected to lower enrollment and increase morbidity.

- Changes in Medical Service Costs: The increasing cost of medical and pharmacy services and supplies impacts the premium rate increases. Cigna anticipates that the cost of medical and pharmacy services and supplies in 2026 will increase over the 2024 level because the prices charged by doctors, hospitals, and other providers are increasing. Additionally, the more frequent use of medical services by customers also increases Cigna's costs. The recent increase in Consumer Price Index (CPI) inflation is adding additional inflationary pressure for network contracts and provider payment mechanisms.

- Changes for the healthiness of the population: The health exchanges for individual plans continue to evolve, following the introduction of the Patient Protection and Affordable Care Act. The overall health of the population is significantly impacted by changes in:

- Enrollment decreases from year to year, as this tends to increase the average healthcare cost of the remaining market enrollees

- Anticipated changes to regulations regarding things like Short Term Medical and Association Health Plans that will impact the Affordable Care Act population are likely to attract healthier consumers away from the individual market, which increases the average healthcare cost per customer

As an aside, this is the first time I've noticed a carriers just coming right out and stating point blank that they expect a large number of ACA exchange enrollees to move to non-ACA compliant junk plans (assuming they're not denied coverage due to pre-existing conditions, of course, and are OK with rampant fraud).

Group Hospitalization & Medical Service:

Projected Number of Insureds Affected: 1,296

...Base rates are changing 1.1% on average. The range is -6.0% to 1.6%. This filing applies to all new and renewing, in-force business in the guaranteed renewable, non-grandfathered, ACA, metaled benefit plans. The approximate number of policyholders (contracts) affected by this rate change is 978.

Reason for Rate Change(s):

The main drivers supporting the rate change are 1) decrease in the base period claims experience, 2) trend, 3) higher projected reinsurance factor, and 4) expiration of the enhanced premium tax credit subsidies at the end of 2025. For a more complete discussion of our morbidity projection, refer to 4.4.3.2, subsection ‘Morbidity Adjustment’ below.

Enhanced Premium Tax Credit Subsidy Expiration Impact

This filing submission includes adjustments to membership, morbidity, and risk adjustment due to the anticipated expiration of federal enhanced premium tax credit subsidies on 12/31/2025. To estimate this impact, the cohort of possible leavers was limited to On-Exchange membership that was active as of March 2025 for consistency with baseline morbidity modeling.

...To estimate the impact on risk adjustment, the results of the above analysis were first compiled by FPL level and the impact on PLRS was estimated. The PLRS impact at each FPL level was applied to publicly available competitor data to estimate the average PLRS impact on the remainder of the market. Finally, an assumption was made that 26.5% of the On-Exchange market will lapse. This assumption was validated using publicly available data, articles, etc. The results of this analysis were compiled to calculate a revised market share and PLRS ratio to the market compared to the subsidies continue scenario . The filed rate change for the subsidies continue scenario was 4.6%.

HealthKeepers:

Anthem HealthKeepers, Inc. has made an application to the Virginia Bureau of Insurance for premium rate changes for its fully ACA-compliant individual health plan products. This filing includes an average rate increase of 20.4%, excluding the impact of aging, effective January 1, 2026. The range by plan is between 13.1% and 23.5%. This increase will impact approximately 140,000 Virginia members renewing in 2026 with Anthem. We expect the majority of members will receive an increase greater than 15%.

A subscriber’s actual rate could be higher or lower depending on geographic location, age characteristics, dependent coverage, and other factors.

...Drivers of Rate Increase

The primary driver of this increase is the sunsetting of enhanced advanced premium tax credits at the end of 2025. Elimination of the enhanced subsidies is anticipated to result in a decrease of healthy membership and higher morbidity in the remaining ACA population. Additional causes are associated with increases in the price of services primarily from hospitals, physicians and pharmacies, coupled with our members increasing their use of health care services, also called “utilization”. Increases in the price of services are driven by technology advances, new medications, and a variety of other factors.

...Adjustments are made to account for the differences between the average morbidity of the experience period population and that of the anticipated population in the projection period. The projected population consists of expected retention of existing policies and new sales. The new sales include the previously uninsured population and previously insured populations from other carriers or markets. The morbidity adjustment reflects projected Anthem and market changes in morbidity, including changes from the expiration of the enhanced ACA premium tax credits on December 31, 2025. Selective lapsation is expected to increase morbidity of the risk pool as a disproportionate number of healthy enrollees is expected to leave the market due to increases in their net premiums after subsidies and economic considerations... The total morbidity change includes a 3.8% additive adjustment for the sunsetting of enhanced APTCs at the end of 2025

Innovation Health Plan:

(Innovation Health Plan is a subsidiary of Aetna/CVS...which is dropping out of the entire individual market nationally in response to Congressional Republicans allowing the upgraded ACA subsidies to expire):

...This letter is formal notice that Innovation Health Plan, Inc. (“IHP”) intends to exit from the Individual health insurance market in Virginia effective January 1, 2026. Subject to the Department’s review, we will mail the 180-day notices of discontinuance to covered individuals.

As of May 2025, our records show that IHP has 17,834 subscribers and 27,720 total members in Virginia.

Kaiser Foundation of the Mid-Atlantic:

The average rate change is 11.60% and the number of current members to which the proposed rate revision applies is 36,390 (14VAC5-130-70.) and assumes the state-based reinsurance program is active for 2026.

4.1 Enhanced ARPA subsidies – The version of rates filed assumes that the enhanced subsidies introduced by ARPA will expire at the end of 2025. This impacts the enrollment and morbidity assumptions used in rate development. The estimated rate impact from this change is around 4.8%. Assumptions that would change if enhanced federal subsidies are continued would be:

- Morbidity – Morbidity factor would decrease from 1.04 to 1.00

- Enrollment – Projected 2026 enrollment would increase by around 20.7%

- Risk Adjustment – Projected 2026 Risk Adjustment transfer would decrease by around $4.00 PMPM

Optimum Choice:

Rate Change: The overall average rate change is 40.2%. The average rate change by plan varies from 38.8% to 53.2%.

Number of Individuals Impacted: There are 25,509 individuals impacted as of March 31, 2025.

...Key Drivers of Change in Medical Service Costs

- Increasing Cost of Medical Services: Annual increases in reimbursement rates to health care providers – such as hospitals, doctors, and pharmaceutical companies.

- Increased Utilization: The number of office visits and other services continues to grow. In addition, total health care spending will vary by the intensity of care and use of different types of health services. The price of care can be affected by the use of expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher Costs from Deductible and Maximum out of Pocket (MOOP) Leveraging: While health care costs continue to rise every year, if deductibles and copayments remain the same, a greater percentage of health care costs need to be covered by health insurance premiums each year.

- Impact of New Technology: Improvements to medical technology, clinical practice, and new prescription drugs require use of more expensive services - leading to increased health care spending and utilization.

- Demographics: Change in the projected age, gender, and metal mix of the underlying population can change the medical claims expected to be incurred.

- Regulatory Changes: The expiration of enhanced premium subsidies passed under the American Rescue Plan Act (ARP) as well as the CMS 2025 Marketplace Integrity and Affordability Proposed Rule are expected to lead to higher costs as healthier enrollees exit the market.

Oscar Insurance:

Reason for Rate Increase(s)

Exhibit A summarizes the proposed rate increases by plan effective January 1, 2026. Rate changes vary by plan due to a combination of factors including shifts in benefit leveraging, cost-sharing modifications, and geographic rating factors. Using in-force business as of March 2025, the proposed average rate change for renewing plans is 3.0%. This rate change is absent of rate changes due to attained age.

...Changes in the Morbidity of the Covered Population

The starting claim experience was adjusted to reflect changes in the anticipated morbidity corresponding to Oscar’s projected demographic mix and membership distributions.

A second adjustment was included to reflect changes in the anticipated market morbidity in response to the uncertainty inherent in the marketplace. Specifically, Oscar anticipated changes to the market morbidity associated with the change in Virginia’s enrollment for the projection period relative to the experience period, due to the ending of the enhanced subsidies introduced by the American Rescue Plan Act, as well as the several new procedures and requirements introduced by the 2025 Marketplace Integrity and Affordability Proposed Rule.

...Enhanced Subsidy Continuation Alternative Rates

In the event that the American Rescue Plan Act enhanced subsidies are extended throughout the 2026 plan year, Oscar anticipates an aggregate reduction to morbidity trend of 3.0%, which results in a final rate change of 0.0% instead of 3.0%. This estimate is preliminary and is subject to change should there be any other regulatory developments impacting the Individual Exchanges, including but not limited to, changes to the 2025 Marketplace Integrity and Affordability Proposed Rule, changes to the enhanced subsidy structure, and the potential funding of Cost Sharing Reductions.

Sentara Health Plans:

The average proposed rate increase of 20.6%, effective January 1, 2026 is expected to impact 109,393 members, based on April 2025 membership. The rate increase varies by plan, area, and tobacco usage, ranging between 11.3% and 55.1%. Rate changes vary by plan due to the impact of changes in benefits and rating adjustments to account for the non-funding of Cost Sharing Reduction (CSR) payments.

...Medical trend for these products is anticipated to be an average of 6.8% per year on allowed claims. This was developed based on historical experience, as well as consideration for information available on changes in the cost of services due to general medical inflation and changes in the anticipated utilization of services. For 2026 cost projections, adjustments to 2024 allowed claims consider population changes and costs. This includes factoring in expected disenrollments resulting from the expiration of enhanced premium subsidies established in the American Rescue Plan Act at the end of 2025. The expiration of these subsidies may lead to higher average statewide morbidity, potentially increasing overall medical costs.

Changes in benefits have been made to these plans, leading to an aggregate 5.5% decrease in rates. Any impact of benefit changes is reflected in the proposed rate changes.

Sentara Health Insurance Co:

Sentara Health Insurance Company’s (SHIC’s) average proposed rate increase of 20.1%, effective January 1, 2026. This change will not impact any members, as there are zero members in this plan based on March 2025 membership. The rate increase varies by tobacco usage status, ranging between 19.5% and 43.4%

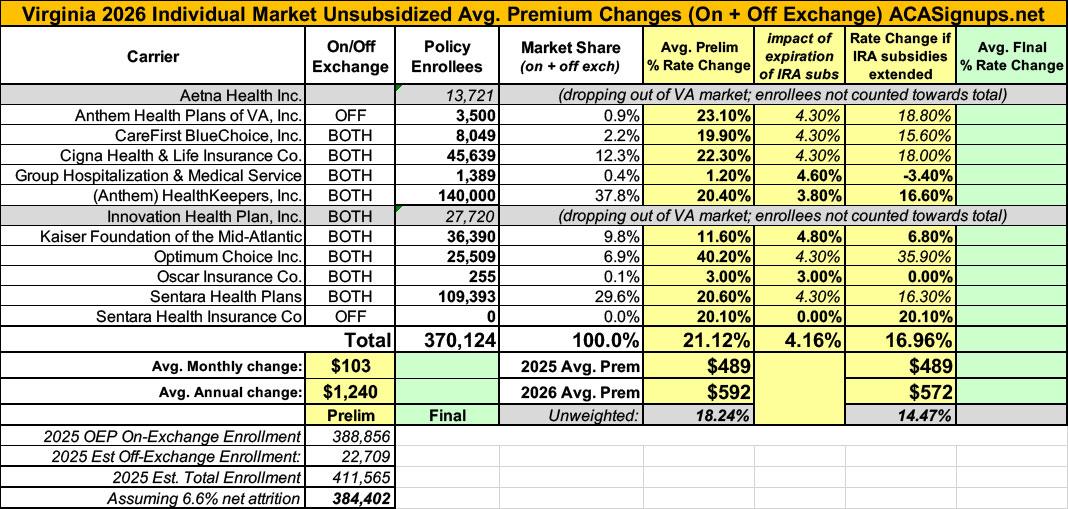

As noted above, both Aetna and Innovation are dropping out of the market; fortunately, both have provided their current enrollment (which is unusual...I'm rarely able to find enrollment data for carriers who are no longer participating). This puts confirmed total VA individual market enrollment at just over 411,000 people, and it means the weighted average preliminary rate increases come in at 21.1% statewide.

HOWEVER, it's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

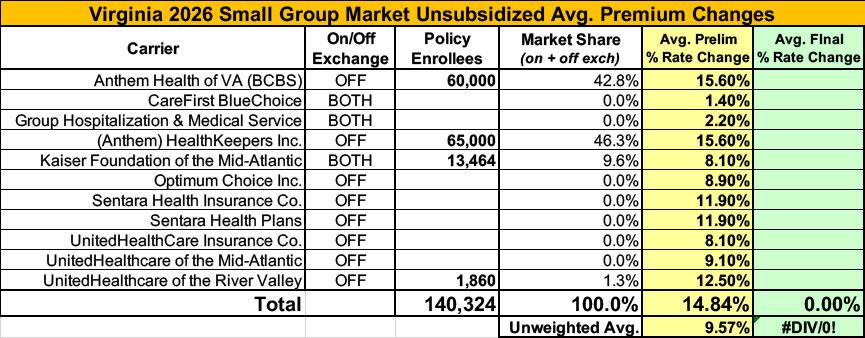

Meanwhile, I have no enrollment data at all for most of the small group carriers; the unweighted average 2026 rate hike there is around 9.6%.

UPDATE 9/23/25: 8 of the 10 carriers participating in Virginia's individual market have published what appear to be their final, approved 2026 rate filings, and the other two only have 4,500 enrollees between them (just 1.2% of the total market), so I'm going ahead and calling it.

In a first for 2026, the final weighted average rate increases for Virginia carriers is slightly higher than the preliminary filings: +21.6%, up from +21.1%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.