2026 Final Gross Rate Changes - Oklahoma: +25.9%; ~315,000 enrollees facing MASSIVE rate hikes (updated)

Originally posted 8/08/25

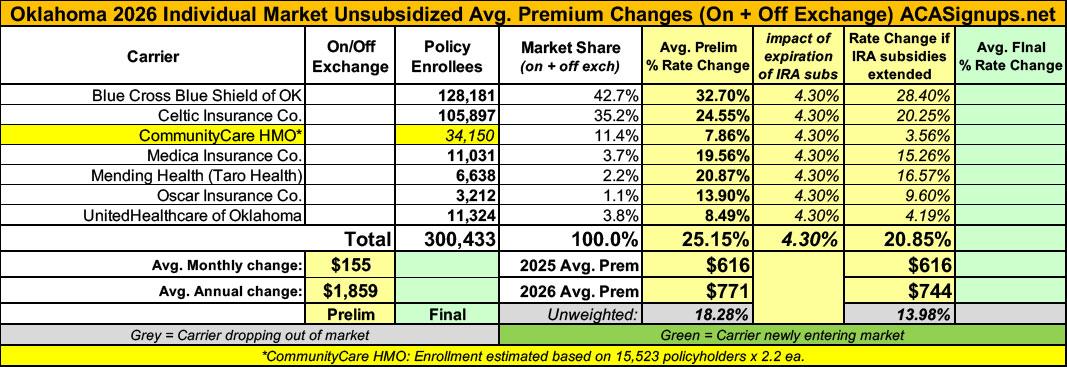

Overall preliminary rate changes via the SERFF database, Oklahoma Insurance Dept. and/or the federal Rate Review database.

Blue Cross Blue Shield of OK

Scope, Range, and Best Estimate of the Rate Increase

Blue Cross and Blue Shield of Oklahoma (BCBSOK) is filing new rates to be effective January 1, 2026, for its Individual ACA metallic coverage. As measured in the Unified Rate Review Template (URRT), the range of rate increases for these plans is 12.3% to 51.5%.

...Changes in allowable rating factors, such as age, geographical area, or tobacco use, may also impact the premium amount for the coverage.

There are currently 128,181 members on Individual Affordable Care Act (ACA) plans that may be affected by these proposed rates.

Celtic Insurance

The results are actuarial projections. Actual experience will differ for a number of reasons, including population changes, claims experience, and random deviations from assumptions. In 2024, earned premium was $588.01 per member per month (PMPM). Incurred claims in 2024 were $243.84, or 41.47% of premium. Netting risk adjustment from the claims results in an estimated loss ratio (incurred claims net of estimated risk adjustment transfers, divided by earned premiums) of 60.00%. We expect unit costs to increase for 2026. Further, we have updated underlying experience for the single risk pool, expected administrative expense, and assumptions for federal risk adjustment. These factors, as well as changes to the assumed morbidity of the single risk pool and medical trend, result in a premium rate increase.

Medical trend, or the increase in health care costs over time, is composed of two components: the increase in the unit cost of services and the increase in the utilization of those services. Unit cost increases occur as care providers and their suppliers raise their prices. Utilization increases can occur as people seek more services than before. Additionally, simple services can be replaced with more complex services over time, which is known as service intensity trend. An example of service intensity trend would be the replacement of an X-ray with an MRI scan. Replacing the service with a more intense service causes the total cost of medical services to increase.

The proposed rate change of 24.5% applies to approximately 105,897 individuals. Celtic Insurance Company’s projected administrative expenses for 2026 are $82.67 PMPM. Administrative expense does not include $30.11 for taxes and fees. The historical administrative expenses for 2025 were $69.57 PMPM, which excludes taxes and fees. The projected loss ratio is 83.1% which satisfies the federal minimum loss ratio requirement of 80.0%.

CommunityCare HMO

CommunityCare HMO, Inc. (CCOK) has submitted its 2026 filing for its Individual HMO product. The weighted average premium increase is 7.9%, with a minimum and maximum increase by plan of 1.8% and 18.0% respectively. The table below shows the rate average increase by metal level and affected policyholders.

Metal Level / Rate Change / Policyholders

- Bronze 11% 9,562

- Silver 11% 4,452

- Gold 8% 1,321

- Catastrophic 13% 188

- Total 10% 15,523

(Note: That's 15,523 policyholders, not actual covered lives; I'm assuming around 2.2x people covered per policy on average. Also, as a side note, I'm not sure how you can have a weighted average of 7.9% when the individual components range between 8 - 13%, but whatever...)

Medica Insurance

Medica Insurance Company (Medica) is requesting a rate change for its individual market business in Oklahoma. The rate change will take effect on January 1, 2026 and will impact an estimated 11,031 members. The average rate change will be 19.6% and will result in rate changes that vary across plan designs. This includes changes to the costs of care.

Medica uses 2024 data from Oklahoma, which includes estimates of changes to the below through 2026:

- Population Medica expects to insure

- Cost of medical services

- Cost of pharmacy services

- Taxes and fees

The significant factors that impact the rate change include those listed above. Claim costs per member per month are expected to change from $344.37 in 2024 to $431.22 in 2026.

In 2024, 85.1% of premium dollars went towards medical services after taxes and fees were removed. Under the ACA, individual products are required to pay at least 80% of premium dollars, after taxes and fees were removed, towards medical services. For 2026, Medica is expecting that 87.0% of premium dollars will be spent on medical services in Oklahoma after taxes and fees were removed.

Medical cost changes, in both number of services and costs of services, make up the largest increase to Medica’s premium rates. Additionally, impacts due to better rates with hospitals and doctors and reviewing recent experience also aid in determining premium changes. Finally, relationships with providers are helping to improve premium rates through a lower overall cost for care.

Medica updates the plan designs offered each year, which impacts each plan’s cost-sharing (e.g. deductibles, copayments, etc.). These updates follow federal rules for how much of costs the insurance company will cover under that plan. Because these updates will be different for each plan, the rate changes will also be different by plan.

Medica expects the cost to administer coverage per member per month (PMPM) for 2026 to be $77.47 which is higher than the 2025 value of $65.40. The main drivers of Medica’s administrative expenses are employee salaries and benefits, agent commissions, claim processing/IT, and clinical/network services

Mending Health (formerly Taro Health)

This submission is for individual health insurance products offered by Mending Health (Mending) in the Oklahoma individual market, available for sale January 1, 2026. Mending is increasing premium rates for individual plans by 20.9% in aggregate, with a minimum of 19.8% and a maximum of 26.4%. As of March 2025, there are 6,638 members who are affected by this rate filing if they were to purchase the same plan in 2026.

...Components of the rate increase include normal secular medical and prescription drug inflation, expected changes in the quantity and type of services used, revised estimates of provider reimbursement levels and changes to the morbidity levels of 2026 enrollees. As a result, six plans (HIOS IDs 58944OK0010002, 58944OK0010003, 58944OK0010006, 58944OK0010007, 58944OK0010008, and 58944OK0010009) have a premium increase for 2026 of greater than 15%.

Benefit design changes were made to a number of cost-sharing parameters, including updating maximum out-of-pockets and deductibles according to federal limits and some adjustments to select copays to remain in compliance with actuarial value limits. The majority of these changes were prescribed by the Center for Consumer Information and Insurance Oversight (CCIO) via Standard plan designs. The highest rate increase is for a silver plan (HIOS ID 58944OK0010008).

Administrative costs changed to be consistent with the 2026 business plan and taking into account the membership loss due to the subsidy expiration at the end of 2025.

Oscar Insurance

The purpose of this document is to present rate change justification for Oscar Insurance Company (Oscar’s) Individual Affordable Care Act (ACA) products in the state of Oklahoma, with an effective date of January 1, 2026, and to comply with the requirements of Section 2794 of the Public Health Service Act as added by Section 1003 of the Patient Protection and Affordable Care Act (ACA).

Using in-force business as of March 2025, the proposed average rate increase for renewing plans is 13.9%. Rate increases vary by plan due to a combination of factors including shifts in benefit leveraging and cost-sharing modifications. This rate increase is absent of rate changes due to attained age.

The rate increase impacts an estimated 3,212 members.

UnitedHealthcare of OK

UHCOK is filing 2026 rates for individual products. The proposed rate change is 8.49% and will affect 11,324 individuals. The rate changes vary between 4.21% and 16.75%. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

The premium collected in plan year 2024 was $90,960,890. Incurred claims during this period were $37,947,895 and UHC expects pay $23,999,328 in risk adjustment. The loss ratio, or portion of premium required to pay medical claims, for plan year 2024 is 68.10%.

There are many different healthcare cost trends that contribute to increases in the overall U.S. healthcare spending each year. These trend factors affect health insurance premiums, which can mean a premium rate increase to cover costs. Some of the key healthcare cost trends that have affected this year’s rate actions include:

- Increasing cost of medical services: Annual increases in reimbursement rates to healthcare providers, such as hospitals, doctors, and pharmaceutical companies.

- Increased utilization: The number of office visits and other services continues to grow. In addition, total healthcare spending will vary by the intensity of care and use of different types of health services. The price of care can be affected using expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher costs from deductible leveraging: Healthcare costs continue to rise every year. If deductibles and copayments remain the same, a higher percentage of healthcare costs need to be covered by health insurance premiums each year.

- Impact of new technology: Improvements to medical technology and clinical practice often result in the use of more expensive services, leading to increased healthcare spending and utilization.

- Expiration of enhanced premium tax credits: Expanded and enhanced federal premium tax credits for consumers will expire at the end of 2025. As a result, post-tax credit premiums will increase for calendar year 2026.

- Changes in market morbidity: Premiums reflect the expected increase in the average cost per member due to healthier members leaving the market if enhanced ATPCs are allowed to expire.

All of the enrollment data is official except for CommunityCare HMO, which only provides the number of policyholders, not actual covered lives. I'm assuming around 2.2x covered lives per policy.

Total 2025 OEP on-exchange enrollment was ~308,000 in Oklahoma; based on 2024 CMS liability risk score data I was expecting the grand total to be more like 315,000 with off-exchange enrollees, but the carriers only total around 300,000, so who knows?

In any event, this gives Oklahoma a weighted average requested individual market rate hike of 25.2%.

It's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

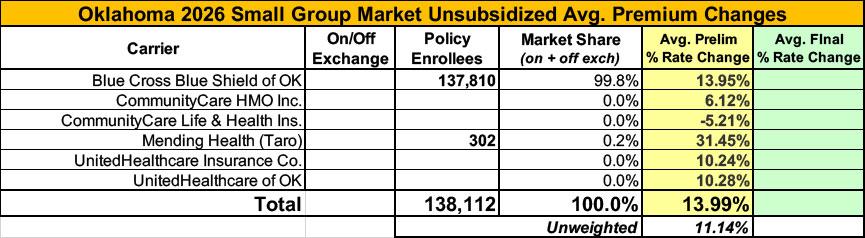

Meanwhile, I have no enrollment data at all for most of the small group carriers; the unweighted average 2026 rate hike there is around 11.1%

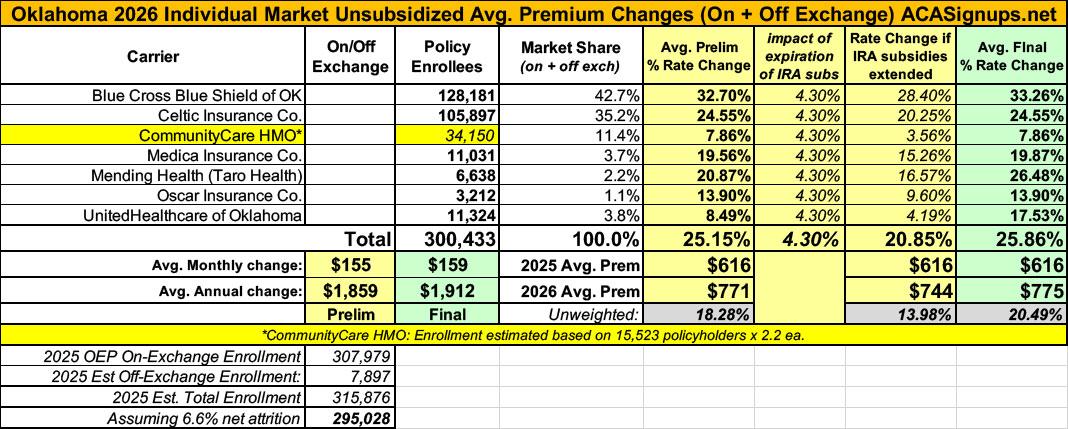

UPDATE 11/01/25: Just hours before Open Enrollment launched, the Oklahoma carriers had their final, approved 2026 ACA individual market filings published and...not much changed. Weighted average rate increase ends up at 25.9%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.