2026 Final Gross Rate Changes - North Dakota: +8.1%

Originally posted 8/08/25

SCROLL DOWN FOR UPDATES

Overall preliminary rate changes via the SERFF database, North Dakota Insurance Dept. and/or the federal Rate Review database.

Blue Cross Blue Shield of ND:

(Unfortunately, BCBSND's actuarial memo is heavily redacted, so I don't know their current enrollment. I've had to make an educated guess on that; see below.)

Medica Health Plans:

Medica Health Plans (MHP) is requesting a rate change for its Affordable Care Act (ACA) individual market business in North Dakota. The rate change will take effect on January 1, 2026 and will impact an estimated 3,454 members. The average rate change will be 17.9% and will result in rate changes that vary across plan designs. This includes changes to the costs of care.

MHP uses 2024 data from North Dakota in addition to Minnesota data that has been adjusted to reflect North Dakota cost characteristics to develop premium rates. This data includes estimates of changes to the below through 2026:

- Population Medica expects to insure

- Cost of medical services

- Cost of pharmacy services

- Taxes and fees

The significant factors that impact the rate change include those listed above. Claim costs per member per month are expected to change from $488.27 in 2024 to $568.32 in 2026.

In 2024, 89.3% of premium dollars went towards medical services. Under the ACA, individual products are required to pay at least 80% of premium dollars, after taxes and fees are removed, toward medical services. For 2026, MHP is expecting that 86.0% of premium dollars will be spent on medical services.

Medical cost changes, in both number of services and costs of services, make up the largest increase to MHP’s premium rates. Additionally, impacts due to better rates with hospitals and doctors and reviewing recent experience also aid in determining premium changes. Finally, relationships with providers are helping to improve premium rates through a lower overall cost for care.

MHP updates the plan designs offered each year, which impacts each plan’s cost-sharing (e.g. deductibles, copayments, etc.). These updates follow federal rules for how much of costs the insurance company will cover under that plan. Because these updates will be different for each plan, the rate changes will also be different by plan.

MHP expects the cost to administer coverage per member per month (PMPM) for 2026 to be $68.20, which is higher than the 2025 value of $63.90. The main drivers of MHP’s administrative expenses are employee salaries and benefits, agent commissions, claim processing/IT, and clinical/network services.

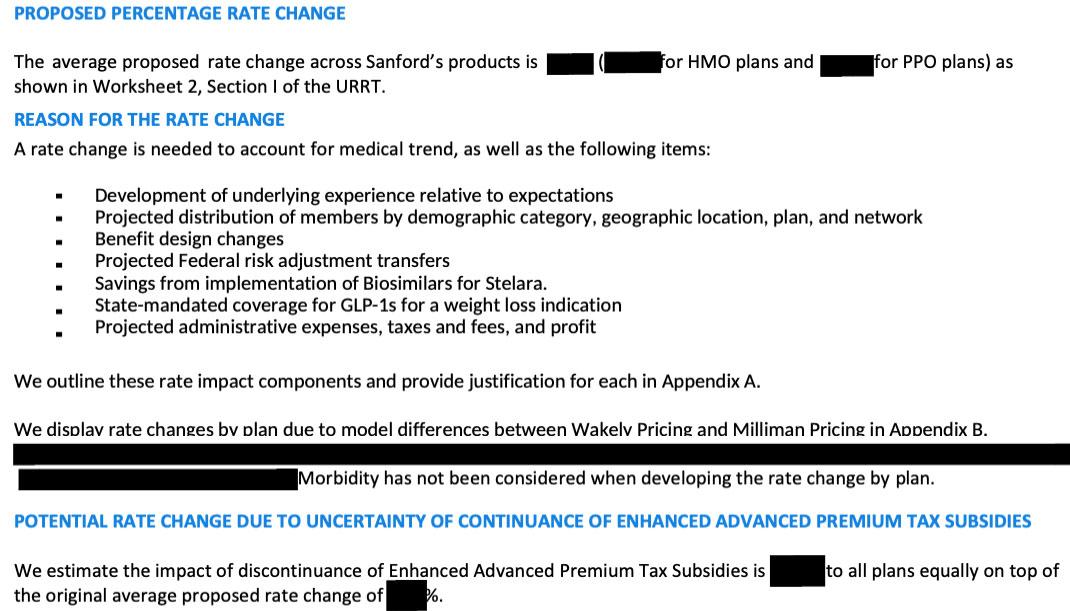

Sanford Health Plans:

(Unfortunately, BCBSND's actuarial memo is heavily redacted, so I don't know their current enrollment. I've had to make an educated guess on that; see below.)

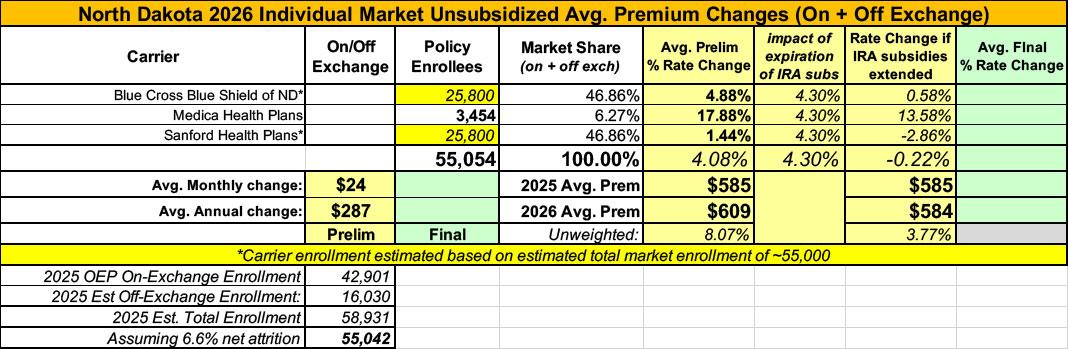

As noted above, I only have actual enrollment data for one of the three insurance carriers in North Dakota's individual market next year. This makes calculating a weighted average far more difficult, but I've made an educated guess.

ND had around 43,000 on-exchange enrollments during the 2025 OEP. Using 2024 CMS liability risk score data I estimate total 2025 individual market enrollment of around 55,000, of which 3,454 are enrolled via Medica...just ~6% of the total.

That leaves around 50,500 enrolled via either BCBS or Sanford. If I assume equal enrollment in each, the semi-weighted average comes in at +4.1%...by far the lowest average increase I've seen so far. This is because even though Medica is asking for a much higher 17.9% increase, the other two carriers, which combine for ~94% of all enrollments, are asking for modest increases of 4.9% and 1.4% respectively.

While ND is officially "semi-weighted," BCBS and Sanford being so close to each other means that the fully-weighted average would remain within a fairly narrow range (2% to 5%) even if one of them had 10x the enrollment of the other.

HOWEVER, It's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

Meanwhile, I have no enrollment data at all for three of the four small group carriers; the unweighted average 2026 rate hike there is around 6.6%.

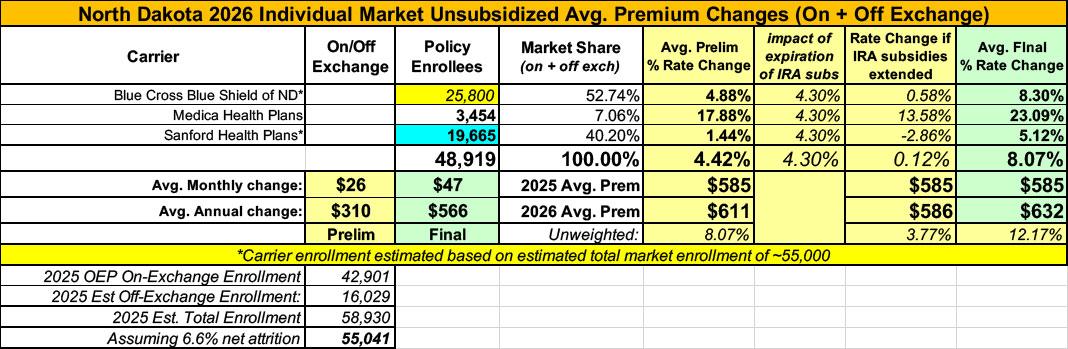

UPDATE 10/28/25: The North Dakota Insurance Dept. has published their final 2026 individual & small group market filing decisions:

North Dakotans Could See Significant Health Insurance Premium Increases in 2026 if Federal Subsidies End

BISMARCK, N.D. – North Dakotans who purchase their own health insurance could face substantial premium increases in 2026 if enhanced federal subsidies are not renewed beyond next year. Insurance Commissioner Jon Godfread has approved 2026 rates for Affordable Care Act (ACA) plans, but the potential expiration of these subsidies could mean some consumers pay significantly more each month—changes that would come in addition to, and separate from, state-approved rate adjustments.

“This year, we asked companies to submit rates based on the assumption that enhanced subsidies would continue,” Insurance Commissioner Godfread said. “They also filed supplemental documentation outlining the potential market impacts if those subsidies were to end. Our approved rates reflect the state’s review and adjustments, but the larger variable for 2026 will be determined at the federal level.”

A large change will also be seen this year for “catastrophic plans” in the individual market. Previously, these plans were only available to younger individuals who met certain requirements. This year, these plans will be made available to those who meet the new eligibility requirements for 2026, regardless of age. These changes resulted in much higher rate increases for 2026 than was originally anticipated for those plans.

While North Dakota’s approved 2026 rates are in place, many consumers who currently receive subsidies could face additional costs due to a reduction in federal subsidy amounts—costs not determined or approved by the state. In some cases, the financial impact could be significant.

“We can and should debate the long-term future of these federal subsidies” Godfread said. “But that debate has to include an honest conversation about health care costs. Hospitals, pharmaceutical companies, and insurers all play a role in affordability. Until those costs come down, or at least stabilize, simply removing the subsidies just leaves consumers exposed.”

...

For the 2026 plan year, Godfread approved the following average base rate changes for the small group market:

- UnitedHealthcare Insurance Company: 8.29%

- Blue Cross Blue Shield of North Dakota: 6.30%

- Sanford Health Plan: 3.91%

- Medica Insurance Company: 7.89%

The following average base rate changes were approved for individual health plans for 2026:

- Blue Cross Blue Shield of North Dakota: 8.30%

- Sanford Health Plan: 5.12%

- Medica Health Plan: 23.09%

In order to offset the effects of changing subsidies, consumers can consider other plan options (such as lower premium silver plans, bronze plans, or catastrophic plans) which may help offset the reduction in advanced tax credits.

These changes may affect deductibles, coinsurance, and provider networks. The Department strongly encourages consumers to review their options carefully and contact their insurance company or a licensed agent to understand how any changes could affect their coverage and out-of-pocket costs, as well as potential impact on network coverage.

“Our goal is transparency,” Godfread added, “North Dakotans deserve to know what’s driving these potential changes. The discussion in Washington is complex and isn’t just about numbers – it’s about real people who have come to rely on these subsidies to find affordable coverage to protect their families. We want North Dakotans to understand what’s driving potential premium changes and to know they have options to help manage costs.”

The statewide weighted average comes in at 8.1% overall, nearly twice as high as the preliminary requested rates were. An 8.1% increase would be either high or in the middle of the pack most other years, but for 2026 it's very much at the low end:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.