2026 Final Gross Rate Changes - Florida: +31.5%; up to 4.5 MILLION Floridians are in for an ugly shock (updated)

Originally posted 8/13/25

SCROLL DOWN FOR IMPORTANT UPDATES

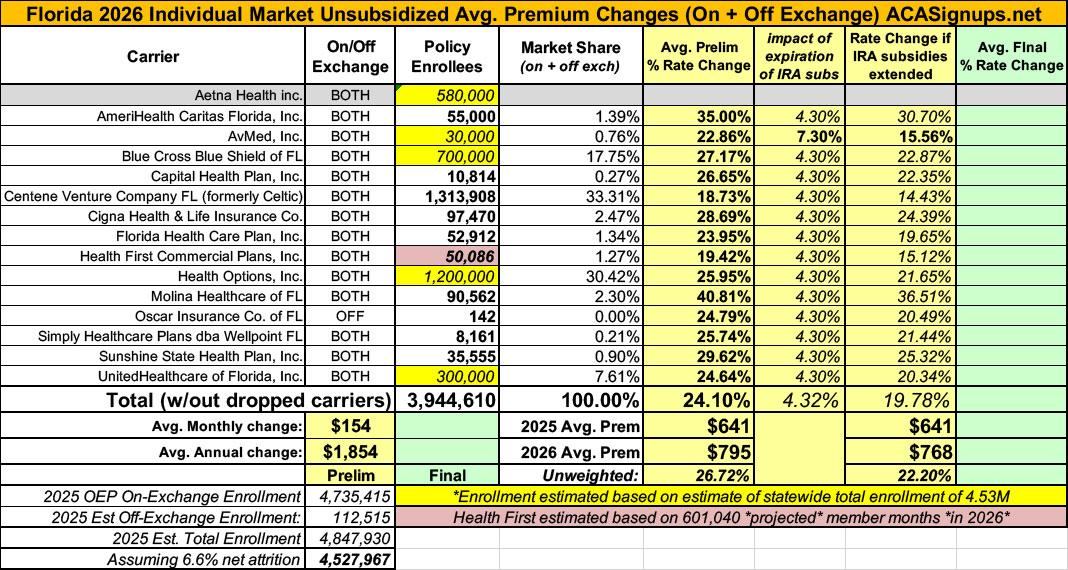

Overall preliminary rate changes via the Florida Office of Insurance Regulation and/or the federal Rate Review database.

Aetna Health inc:

(Aetna/CVS announced last spring that they're pulling out of the individual market in EVERY state in 2026.)

AmeriHealth Caritas Florida:

Amerihealth Caritas Florida, Inc. (AHC) has offered comprehensive and fully insured coverage to members in the individual ACA market since 2023. AHC is filing a rate increase for 2026 products. The plans associated with this filing will be offered both on and off the Federally Facilitated Marketplace (FFM) in Florida.

The products associated with this filing will cover a wide range of benefits, including all Essential Health Benefits (EHBs) required under the ACA, with the exception of pediatric dental benefits. Stand-alone pediatric dental plans are available to satisfy the EHB requirements. All plans will utilize an HMO network with no self-directed out-of-network benefits available, unless required by law (i.e., out-of-area emergency care). AHC will offer plans at the bronze, silver, and gold metallic levels. Cost-sharing reduction (CSR) plans will be available. Services will be subject to deductibles, copays, and coinsurance; member cost-sharing will be limited to out-of-pocket maximums (OOPMs).

A range of cost-sharing options will be provided to consumers, including deductible options ranging from $0 to $10,600, member coinsurance options ranging from 0% to 50%, and OOPM options ranging from $1,700 to $10,600 for single coverage. Some plans will feature copays for physician services and prescription drug fills. No substitutions were made from the Florida standard EHBs, and all plan designs include state mandated benefits. All benefit plans will cover the following non-EHBs: members will have access to a Weight Watchers program through a class voucher and a program that provides members with a reloadable gift card that can be used for preventable health care.

The average rate change for individuals renewing in 2026 is 35.0%, with the minimum and maximum rate changes equal to 22.7% and 38.2%, respectively. The proposed rate changes vary by plan due to changes in the paid to allowed ratios underlying the actuarial value and cost sharing components of the Plan Adjusted Index Rates. The paid to allowed ratios for all plans were updated to reflect the anticipated claim costs associated with the projected 2026 AHC Individual ACA population.

The primary drivers of the average rate change are summarized below:

- The expectation that the enhanced premium tax credits associated with the American Rescue Plan Act will expire at the end of 2025;

- The impact of medical inflation on projected claim costs;

- Changes to the CSR load applied to silver on-Exchange plans to account for the cost of CSR subsidy payments, which are assumed to not be funded by the federal government in 2026;

- Anticipated elevated provider contracting;

- Expected statewide premium increase in 2026 driving up projected risk adjustment payable amounts.

- The rate change is estimated to impact approximately 55,000 members.

AvMed:

This submission is for the following rate revisions and new benefit plans, effective January 1, 2026:

- Rate revisions to existing AvMed individual medical ACA-compliant products, as presented by HIOS Plan ID in the applicable line item of Worksheet 2 in the URRT. The average proposed rate change across all plans from the most recently approved rates effective January 1, 2025, is an increase of 22.9%. The cumulative average rate change over the past 12 months is the same, since the most recently approved rates were effective January 1, 2025.

- Proposed premiums for new individual benefit plans to be available for sale effective January 1, 2026.

To the extent that current membership in terminating plans are proposed to be mapped into another plan, the applicable rate change is illustrated in the URRT and included in the previously noted average.

IMPACT OF ARPA ENHANCED PREMIUM SUBSIDIES

As instructed by OIR, we prepared this set of rate filing materials assuming the ARPA enhanced premium subsidies will expire at the end of 2025 and not be available in 2026. As detailed in this actuarial memorandum, we apply adjustments to projected 2026 membership and to overall market morbidity due to the expected disenrollments resulting from expiration of the enhanced subsidies. OIR also requested payers provide the projected rate impact if the enhanced subsidies were to continue. The impact to rates if the enhanced subsidies were to continue is a decrease of 7.3% from the filed rates. This change reflects a removal of the market morbidity increase and shifts in the mix of business resulting from expected disenrollments (e.g., age, metallic mix, etc.) due to expiration of the ARPA enhanced subsidies, as well as changes in the applicable exchange fee under the “enhanced subsidies continue” scenario. Please see Exhibit 5 for additional discussion of expected changes due to the expiration of ARPA enhanced premium subsidies.

REASON FOR RATE CHANGES

The proposed rate changes reflect consideration for the impact of a number of factors, including:

- 2024 experience and emerging 2025 membership.

- Anticipated medical and pharmacy cost and utilization trends.

- Consideration for anticipated changes in the average morbidity of the AvMed covered population and general marketplace, including any impact from expiration of the ARPA enhanced premium subsidies.

- Changes in demographic mix of business.

- Benefit changes.

- Changes to projected non-benefit expenses and risk margin.

Rate changes vary by benefit plan and / or rating area to reflect a combination of the following:

- Benefit changes.

- The anticipated impact of fixed cost-sharing parameters and deductible leveraging given increasing medical costs (i.e., paid to allowed).

- Changes related to the non-funding of CSR subsidies, including reflecting historical experience, changes in member mix, and changes to the premium rate adjustment applicable to on-exchange Silver plans to account for CSR funding, as prescribed by OIR.

- Updates to rating area factors reflecting considerations for recent experience and a review of other marketplace area relativities to help further evaluate costs in the delivery of care.

Blue Cross Blue Shield of FL (Florida Blue):

This rate action is proposed for all BlueOptions and BlueSelect products that are fully compliant with the Patient Protection and Affordable Care Act (PPACA).

- The proposed rate increase will have varying impacts on individuals, with some experiencing increases above 15%.

- The product's historical financial performance has been closely monitored, and the proposed rate increase is intended to ensure that the product's financial experience remains stable and compliant with regulatory requirements. The rate increase is expected to support a Medical Loss Ratio (MLR) that meets or exceeds the 80% requirement for Individual business, as mandated by the Affordable Care Act (ACA). This means that a significant portion of premium revenue will be dedicated to paying for medical care and quality improvement activities, with any excess premiums potentially subject to rebate requirements.

The proposed rate action is due to the following reasons:

- Market Risk (Expiration of American Rescue Package (ARP) and implementation of Market Integrity Ruling)

- A morbidity adjustment factor that is included to reflect an anticipated worsening of claims experience in 2026 from 2024 due to the Market Integrity Rule and the expiration of ARP.

- Reduction in risk transfer due to deteriorating market risk.

- Increased Exchange User Fee (EUF) solely due to expiration of ARP, per Notice of Benefit and Payment Parameters.

- Market Size

- Blue Cross and Blue Shield of Florida, Inc. projects the Individual Under 65 market size to be smaller in 2026 than in 2025.

- Medical Inflation (Trend)

- Medical Trend: Combined effect of medical provider price increases, utilization changes, medical cost shifting, specialty pharmacy, and new medical procedures and technology.

- Insurance Trend: Impact of leveraging on plans with fixed dollar cost shares.

- Prospective changes to covered benefits

- Coverage for Essential Health Benefits not reflected in the base experience data: US Preventive Services Task Force (USPSTF) and other mandated changes.

- Risk Adjustment Transfer

- Changes in 2026 to the CMS Risk Adjustment coefficients.

- Taxes and Fees

- Change in the Risk Adjustment User Fee to $0.20 PMPM from $0.18 PMPM.

- Change in the Patient-Centered Outcomes Research Institute (PCORI) fee estimated at $0.31 PMPM.

- Change in the Exchange User Fee (EUF) from 1.5% to 2.5%.

Capital Health Plan:

Scope and Range of the Rate Increase

CHP is filing rates to be effective January 1, 2026 for its Individual ACA-compliant block of business. URRT Rate increases by Plan HIOS ID vary between 17.07% and 35.60%. The Product Rate Increase and average rate increase across all plans is 26.65%, as also measured in the URRT.

There are several factors contributing to the requested rate increases. These include medical and pharmacy cost inflation, morbidity increases due to the discontinuation of enhanced premium tax credits established by the American Rescue Plan and implementation of market integrity rules, and an increase in silver loading for plan year 2026.

The above rate increases will apply to CHP’s projected marketplace enrollment consisting of 129,778 member months in 2026 as shown in WS2 of the URRT.

The following sections provide a summary of the historical experience of CHP’s ACA-compliant plans, alongside a discussion of the key factors that contribute to the rate increases displayed in the URRT.

Centene Venture Co FL:

The proposed rate change of 18.7% applies to approximately 1,313,908 individuals. Centene Venture Company Florida’s projected administrative expenses for 2026 are $90.11 PMPM. Administrative expense does not include $18.08 for taxes and fees. The historical administrative expenses for 2025 were $75.91 PMPM, which excludes taxes and fees. The projected loss ratio is 82.8% which satisfies the federal minimum loss ratio requirement of 80.0%.

Celtic:

(Celtic APPEARS to be dropping out of the ACA individual market in Florida, though I can't be certain of this)

Cigna Health & Life Insurance:

Cigna estimates that 97,470 customers will be impacted by this rate increase. On average, customers will see an increase of 28.68%, excluding the impact of aging, with a range of increases from -1.99% to 45.07%. In addition to the factors described below, each customer’s rate increase depends on factors such as where they live and what plan they are enrolled in.

The most significant factors causing the rate increase are:

- Expiration of APTC Subsidies: This rate filing assumes that APTC subsidies will expire on 12/31/2025. The conclusion of the enhanced subsidies is expected to lower enrollment and increase morbidity.

- Changes in Medical Service Costs: The increasing cost of medical and pharmacy services and supplies impacts the premium rate increases. Cigna anticipates that the cost of medical and pharmacy services and supplies in 2026 will increase over the 2024 level because the prices charged by doctors, hospitals, and other providers are increasing. Additionally, the more frequent use of medical services by customers also increases Cigna's costs. The recent increase in Consumer Price Index (CPI) inflation is adding additional inflationary pressure for network contracts and provider payment mechanisms.

- Changes for the healthiness of the population: The health exchanges for individual plans continue to evolve, following the introduction of the Patient Protection and Affordable Care Act. The overall health of the population is significantly impacted by changes in:

- enrollment decreases from year to year, as this tends to increase the average healthcare cost of the remaining market enrollees

- anticipated changes to regulations regarding things like Short Term Medical and Association Health Plans that will impact the Affordable Care Act population are likely to attract healthier consumers away from the individual market, which increases the average healthcare cost per customer

- Plan design changes and benefit modifications: Changes have been made to plans that are resulting in an increase in expected cost share and therefore an increase to premium. All plan designs conform to actuarial value and essential health benefit requirements.

Florida Health Care Plan:

Florida Health Care Plans (FHCP) estimates that 52,912 customers will be impacted by this rate increase. On average our customers will see a 24.0% increase, with a range of 7.5% to 46.2%. A customer’s actual rate could be higher or lower depending on age, tobacco usage, dependent coverage, geographic location, and other factors.

...Significant Drivers of the rate increase

Expiration of Expanded APTC and Implementation of Payment Integrity Rule- The expiration of expanded APTC and the implementation of the payment integrity rule are the main drivers of the overall rate increase.

Changes in Medical Service Cost- Medical and Rx cost are the other main drivers of the overall rate increase.

Change in benefits- There was no significant change in benefits. Changes have been made to keep plans in de minimis range to keep plans in the respective metal tier. These changes were not major drivers of the rate increase.

Administrative cost and anticipated margin- FHCP’s target loss ratio is above the 80% threshold. It is also not a major driver of the rate increase.

Health First Commercial Plans:

Scope and Range of the Rate Increase

HFCP is filing rates to be effective January 1, 2026 for its Individual ACA-compliant block of business. URRT rate increases by Product HIOS ID vary between 15.22% and 21.82%. URRT Rate increases by Plan HIOS ID vary between 12.29% and 25.07%. The average rate increase across all plans is 19.42%, as also measured in the URRT.

There are several factors contributing to the requested rate increases. These include medical and pharmacy cost inflation, lower estimated risk transfers relative to those assumed in 2025 rates, morbidity increases due to the discontinuation of enhanced premium tax credits established by the American Rescue Plan and implementation of market integrity rules, and an increase in silver loading for plan year 2026.

The above rate increases will apply to HFCP’s projected marketplace enrollment consisting of 601,040 member months in 2026 as shown in WS2 of the URRT.

Health Options:

- The proposed rate increase will have varying impacts on individuals, with some experiencing increases above 15%.

- The product's historical financial performance has been closely monitored, and the proposed rate increase is intended to ensure that the product's financial experience remains stable and compliant with regulatory requirements. The rate increase is expected to support a Medical Loss Ratio (MLR) that meets or exceeds the 80% requirement for Individual business, as mandated by the Affordable Care Act (ACA). This means that a significant portion of premium revenue will be dedicated to paying for medical care and quality improvement activities, with any excess premiums potentially subject to rebate requirements.

The proposed rate action is due to the following reasons:

- Market Risk (Expiration of American Rescue Package (ARP) and implementation of Market Integrity Ruling)

- A morbidity adjustment factor that is included to reflect an anticipated worsening of claims experience in 2026 from 2024 due to the Market Integrity Rule and the expiration of ARP.

- Reduction in risk transfer due to deteriorating market risk.

- Increased Exchange User Fee (EUF) solely due to expiration of ARP, per Notice of Benefit and Payment Parameters.

- Market Size

- Health Options, Inc. projects the Individual Under 65 market size to be smaller in 2026 than in 2025.

- Medical Inflation (Trend)

- Medical Trend: Combined effect of medical provider price increases, utilization changes, medical cost shifting, specialty pharmacy, and new medical procedures and technology.

- Insurance Trend: Impact of leveraging on plans with fixed dollar cost shares.

- Prospective changes to covered benefits

- Coverage for Essential Health Benefits not reflected in the base experience data: US Preventive Services Task Force (USPSTF) and other mandated changes.

- Risk Adjustment Transfer

- Changes in 2026 to the CMS Risk Adjustment coefficients.

- Taxes and Fees

- Change in the Risk Adjustment User Fee to $0.20 PMPM from $0.18 PMPM.

- Change in the Patient-Centered Outcomes Research Institute (PCORI) fee estimated at $0.31 PMPM.

- Change in the Exchange User Fee (EUF) from 1.5% to 2.5%.

Molina Healthcare of FL:

1. Scope and range of the rate increase: Molina’s proposed rates represent an overall rate change of 40.8% for the 90,562 Molina members enrolled in continuing plans effective March 2025. The proposed rate changes vary by metal tier. Members would receive premium changes ranging from 21.6% to 76.7% depending on their geographic location, metal tier, and age.

...3. Changes in Medical Service Costs: Medical inflation related to the utilization and cost of covered services increased claims by 14.6%. Historical medical and pharmacy claims experience and prospective trend are the primary contributors to an increase in rates. Changes in provider contracting rates also contributes to the regional rate changes.

4. Changes in Benefits: Molina is renewing nine gold, silver, and bronze plan offerings from 2025. The impact on rates from benefit design changes for all renewal plans is minimal.

5. Administrative costs and anticipated profits: Total administrative expenses are expected to increase, contributing to an increase in rates of approximately 0.2%. Targeted profit margin remains the same as the prior year’s filing.

6. Program Changes: The expiration of the enhanced Premium Tax Credits (eAPTCs) and Program Integrity will lead to people leaving Marketplace, with a higher skew of healthier people leaving and therefore driving up the acuity in the risk pool.

Oscar Insurance of FL:

The purpose of this document is to present rate change justification for Oscar Insurance Company of Florida (Oscar’s) Individual Affordable Care Act (ACA) products, with an effective date of January 1, 2026, and to comply with the requirements of Section 2794 of the Public Health Service Act as added by Section 1003 of the Patient Protection and Affordable Care Act (ACA).

Using in-force business as of March 2025 , the proposed average rate increase for renewing plans is 13.3%. Rate increases vary by plan due to a combination of factors including shifts in benefit leveraging and cost-sharing modifications. This rate increase is absent of rate changes due to attained age.

The rate increase impacts an estimated 142 members.

...The projection assumes full membership persistency. Oscar assumes members exiting Oscar’s population will have similar characteristics to those enrolling, and thus make no adjustments for lapses. There are currently 142 members that will be affected by a rate change.

Exhibit I summarizes the membership projection by metal level, including the alternative variant silver plans which CSR eligibles can purchase, and exchange status.

IMPORTANT: This is VERY strange. Oscar is still a major player in the Florida ACA individual market, so only having 142 enrollees makes little sense. According to CMS's 2024 Issuer Level Enrollment public use file, they had 797,000 enrollees on average each month last year. For that matter, overall enrollment is up 12% year over year.

It's pretty unlikely that they've completely dried up...and yet they repeat the 142 figure in the longer actuarial memo as well, so it doesn't appear to be a typo.

The only potential explanation is the "...rate increases impact" caveat. Sometimes a carrier will increase (or even reduce) rates on some policies but not others. The filings often only include the portion of their enrollees who are "impacted by" the rate changes.

However, the only way this would work here is if Oscar is only increasing premiums on plans which just 142 people are enrolled in while leaving rates for plans with hundreds of thousands of enrollees exactly the same...which I also find impossible to believe.

Regardless...that's what Oscar claims in their filing (see linked file below), so...I don't know what else to do with this.

Simply Healthcare dba Wellpoint FL:

Table 1 summarizes the significant factors driving the proposed composite rate change effective January 1, 2026.

The manual rate claims costs were increased for anticipated changes due to medical / prescription drug inflation and increased medical / prescription drug utilization. We also updated certain factors used in the calibration of the multi-state manual rate experience to align with expectations for the Florida individual market. The manual morbidity factor increased primarily due to the expectation of worsened morbidity in the market coinciding with the assumed expiration of enhanced premium tax credits in 2026. The manual geographic factor increased due to revised expectations in Wellpoint’s utilization and unit costs in Florida relative to the manual experience.

Similar to the 2025 rate filing, we projected average statewide premiums for 2026 and assumed a risk adjustment payable that aligns with the underlying morbidity assumption utilized in the claims projections. This led to a similar, but slightly lower projected risk adjustment payable as a percent of premium compared to the 2025 rate filing. We also reflect Wellpoint’s latest administrative expense assumptions.

Table 2 shows rate increases by plan along with current rates and enrollment as of March 31, 2025. The minimum rate increase requested is 20.1% and the maximum rate increase requested is 27.9%

Sunshine State Health Plan:

The proposed rate change of 29.6% applies to approximately 35,555 individuals. Sunshine State Health Plan, Inc.’s projected administrative expenses for 2026 are $89.75 PMPM. Administrative expense does not include $18.63 for taxes and fees. The historical administrative expenses for 2025 were $77.55 PMPM, which excludes taxes and fees. The projected loss ratio is 83.2% which satisfies the federal minimum loss ratio requirement of 80.0%.

UnitedHealthcare of FL:

UHC is filing 2026 rates for individual products. The proposed rate change is [Redacted: TRADE SECRET] and will affect [Redacted: TRADE SECRET] individuals. The rate changes vary between [Redacted: TRADE SECRET] and [Redacted: TRADE SECRET]. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

....There are many different healthcare cost trends that contribute to increases in the overall U.S. healthcare spending each year. These trend factors affect health insurance premiums, which can mean a premium rate increase to cover costs. Some of the key healthcare cost trends that have affected this year’s rate actions include:

- Increasing cost of medical services: Annual increases in reimbursement rates to healthcare providers, such as hospitals, doctors, and pharmaceutical companies.

- Increased utilization: The number of office visits and other services continues to grow. In addition, total healthcare spending will vary by the intensity of care and use of different types of health services. The price of care can be affected using expensive procedures such as surgery versus simply monitoring or providing medications.

- [Redacted: TRADE SECRET]

There's several important caveats here.

First, due to Florida having sweeping "Protected as Trade Secret" laws, I've only been able to find the actual current enrollment data for 10 of the 16 carriers participating in the individual market...and only one of those is a major player (Centene Venture).

Second: At first I thought that Celtic (which has been on the FL indy market for years now) was dropping out, but it turns out they changed their name to Centene Venture at the beginning of this year, according to their 2025 actuarial memo...so there's only 15 carriers for 2026:

Beginning January 1, 2025, Celtic will be moving its On-Exchange EPO membership to a new HMO license under Centene Venture Company Florida (CVC). The new HMO license will have new plan IDs, but we have used existing experience for these plans to build pricing off of."

Third: As noted above, Oscar Health claims (in at least 2 locations) that they only have 142 enrollees even though they should have something like 800,000. I have no idea what to do with that.

Over 4.7 million Floridians are enrolled in on-exchange policies this year, plus perhaps another ~100K or so enrolled in off-exchange plans. All told, that's over 4.8 million people, but the enrollment data for the 10 carriers I have data for only accounts for around 1.7 million, or 35% of the total.

This means the remaining ~3.13 million have to be broken out across the remaining 5 carriers. Normally I would just divide the balance evenly, but given how many "blank" carriers there are and how many enrollees are unaccounted for, I'd prefer to press further.

Here's what every carrier averaged in 2024, vs. their spring 2025 enrollment where known:

- Aetna (dropping out): 584,746 / ???

- AmeriHealth Caritas: 4,261 / 55,000

- AvMed: 7,008 / ???

- BCBS FL: 363,962 / ???

- Capital Health Plan: 9,134 / 10,814

- Centene Venture (formerly Celtic): 983,410 / 1,313,908

- Cigna: 95,150 / 97,470

- Florida Health Plan: 51,206 / 52,912

- Health First Commercial: 49,245 / 50,086

- Health Options: 933,530 / ???

- Molina: 77,956 / 90,562

- Oscar: 796,990 / 142 ???

- Simply Healthcare / Wellpoint FL: n/a

- Sunshine State: 61,723 / 35,555

- UnitedHealthcare: 144,797 / ???

Aside from AmeriHealth Caritas, which has seen a dramatic enrollment increase, the other known enrollment carriers all seem pretty reasonable (Oscar aside)--most are close to or somewhat higher than 2024, while Sunshine State has dropped significantly.

Based on this, unless I get better info, I'm going to assume the ~3.13 million "missing" enrollees are broken out as follows:

- Aetna (dropping out): ~700,000

- AvMed: ~30,000

- BCBS FL: ~800,000

- Health Options: ~1.3 million

- UnitedHealthcare: ~300,000

Having said this, when you look at the average rate changes for the AvMed, BCBS, Health Options and UHC, they range from 22.9% to 27.2%...and even if Oscar's actual enrollment is far higher than 142, their requested rate increase is 24.8% as well. In other words, no matter how far off I am on any of the estimated enrollment numbers, the fully-weighted average increase is still going to be within a point or two of the 24.2% shown below.

UPDATE 8/15/25: I forgot to account for net total enrollment attrition since the end of January. Nationally, CMS stated that on-exchange individual market enrollment had dropped by around 6.6% as of April (which is pretty typical; for the past few years it has pretty much stabilized after that).

I don't know what the net attrition is for Florida specifically, but if I apply that 6.6% to the statewide total it knocks it down to around 4.53 million.

Since the known enrollment for most carriers was as of March/April, that means the balance has to be found among the 5 carriers with unknown enrollment. I'm therefore reducing my estimates like so:

- Aetna (dropping out): ~580,000

- AvMed: ~30,000

- BCBS FL: ~700,000

- Health Options: ~1.2 million

- UnitedHealthcare: ~300,000

As noted earlier, this doesn't move the needle much, however; as shown in the updated table below, it reduces the weighted average slightly from 24.2% to...24.1%.

HOWEVER, it's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

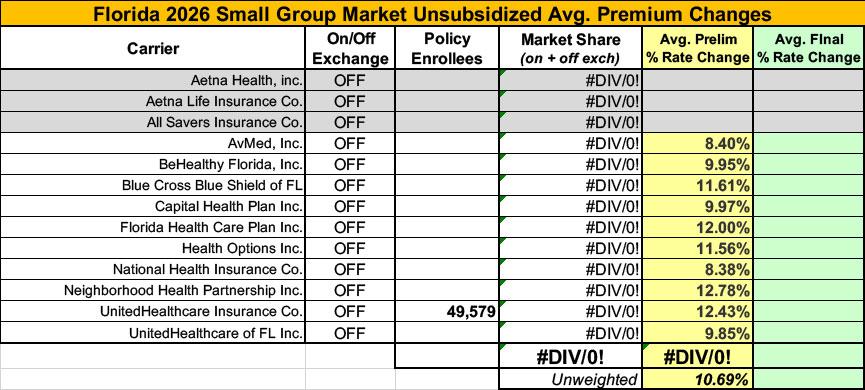

Meanwhile, I have no enrollment data for most of the small group carriers; the unweighted average 2026 rate hike there is 10.7%.

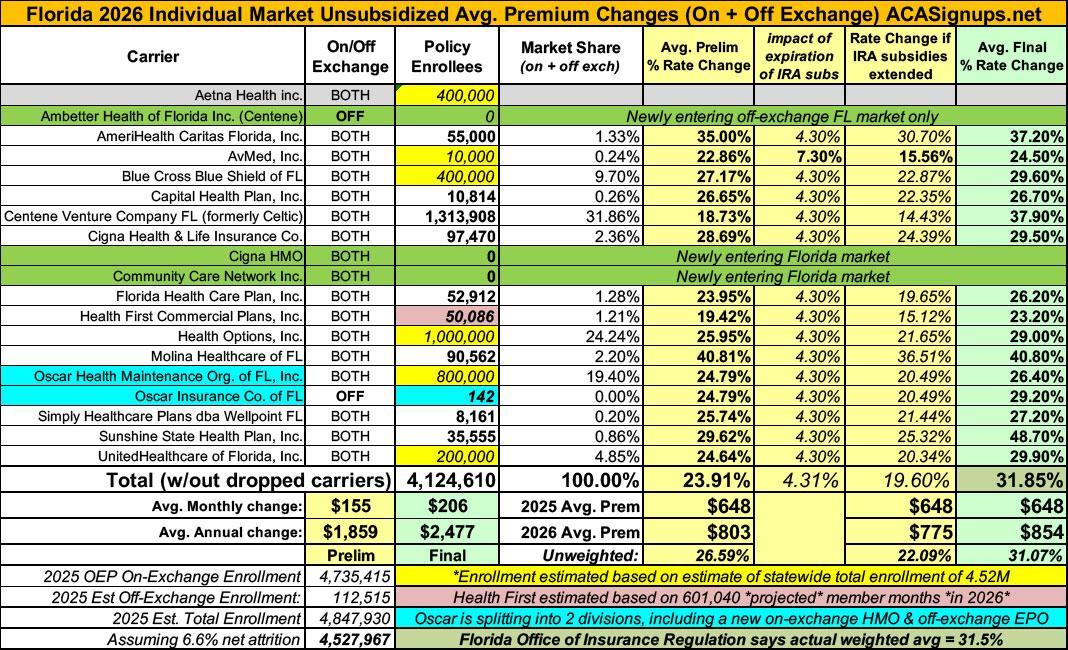

UPDATE 10/17/25: Oh for heaven's sake. It turns out that the Florida Office of Insurance Regulation (FLOIR) quietly published their final/approved 2026 rate filings for the individual market over two months ago and I didn't find out about it until now! A big shout-out to "techbud251" in the comments for alerting me to this PDF buried in the FLOIR website, with the final column labeled "Average % Change Approved."

Even more face-palming: The actual PDF is dated 8/15/25 in the lower right corner...just 2 days after I published Florida's preliminary filings. Sheesh.

In any event, while Florida still frustratingly doesn't post the actual number of enrollees each carrier has, they do state at the bottom that the Weighted Average using Actual Membership is a 31.5% increase.

This is over 7 percentage points higher than I had estimated using their preliminary filings...and while some of this is due to my having to make pretty wild guesstimates as to how many enrollees several of the larger carriers have, most of it is due to FLOIR's final/approved rate decisions being higher for every carrier, and significantly higher for several of them.

In particular, Centene Venture (formerly Celtic), which holds over 30% of the total market, jumed from 18.7% to 37.9%, and Sunshine State (which has less than 1% of the market) went from 29.6% to a stunning 48.7% average rate increase.

In addition to the jaw-dropping rate hikes, there's also some other noteworthy developments:

- Ambetter Health of FL (Centene) is newly entering the Florida market, but only off-exchange

- Another new entrant (both on & off-exchange) is Community Care Network, an offshoot of the VA Dept. which operates only in Broward County, providing care near VA facilities

- Meanwhile, techbud's comment also alerted me to what appears to be the answer to the "Oscar Insurance Co" mystery I wrote about above. As noted in the FLOIR footnotes:

Oscar enters with a new HMO participating On and Off Exchange. Values in the table are based on Oscar EPO 2025 On Exchange membership. Oscar EPO is now Off Exchange only.

This explains why a carrier which actually has up to 800,000 enrollees only listed 142 enrollees in their preliminary filing--it sounds like the rest of them are being recategorized and moved to an off-exchange division, while the "new" on-exchange HMO variant is being added.

In any event, here's what the final table looks like...I know this is messy as hell, and the weighted average I come up with is slightly different from what FLOIR says (31.9% vs. their 31.5%). This is mostly due to my still having to make guesses as to the actual enrollment numbers for Aetna, AvMed, BCBS, Health Options, Oscar and UnitedHealthcare:

UPDATE 10/20/25: One very minor addition: I forgot to note that Cigna, which already offers PPO plans on the Florida exchange, is also newly launching an HMO division as well. Not sure how I missed that; the spreadsheet below has been updated to include this.