2026 Final Gross Rate Changes - Texas: +34.7% (updated)

Originally posted 8/29/25

Overall preliminary rate changes via the SERFF database, Texas Insurance Dept. and/or the federal Rate Review database.

Access to Care Health Plan:

(Access to Care Health Plan is a division of Sendero; unfortunately, they've heavily redacted their actuarial memo and I can't find a justification summary)

Aetna Health:

Aetna is dropping out of the individual market nationally in 2026. In texas, they've provided a market withdrawl letter which includes the exact number of current enrollees in each region of the state:

"Aetna is totally withdrawing from the individual (off and on-exchange) market, effective December 31, 2025. Individuals currently covered under an Aetna plan will need to make a different plan selection for 2026. In accordance with Texas and federal law, consumers will be given 180 days’ notice of the termination of their policy."

- Austin: 11,745

- Corpus Christi: 4,373

- Dallas: 56,478

- El Paso: 19,830

- Houston: 64,599

- Midland-Odessa: 10,943

- Rio Grande: 275

- San Antonio: 40,071

All told, that's 208,314 current enrollees statewide.

Baylor Scott & White Health Plan

Baylor Scott & White Health Plan (BSWHP) is requesting an average annual rate increase of 23.71% to HMO products on the Individual Health Insurance Single Risk Pool effective on 01-01-2026.

Changes in Medical Service Costs

BSWHP used an assumption of 6.5 percent for medical inflation. Unit cost of medical benefits is expected to increase, and utilization of medical services is expected to increase, resulting in unfavorable costs for BSWHP. The remainder of the overall rate change is due to other factors such as changes in membership mix, changes in administrative costs, benefit changes, and changes in risk adjustment parameters.

Baylor Scott & White Insurance Co

Baylor Scott & White Insurance Company (BSWIC) is requesting an average annual rate action of 19.55% to EPO products on the Individual Health Insurance Single Risk Pool effective on 01-01-2026.

Changes in Medical Service Costs

BSWIC used an assumption of 8.2 percent for medical inflation. Unit cost of medical benefits is expected to increase, and utilization of medical services is expected to increase, resulting in unfavorable costs for BSWIC. The remainder of the overall rate change is due to other factors such as changes in membership mix, changes in administrative costs, benefit changes, and changes in risk adjustment parameters.

Blue Cross Blue Shield of TX

Blue Cross and Blue Shield of Texas (BCBSTX) is filing new rates to be effective January 1, 2026, for its Individual ACA metallic coverage. As measured in the Unified Rate Review Template (URRT), the range of rate changes for these plans is 8.9% to 64.7%. The following are the average rate increases by product:

Product Rate Increase

- Blue Advantage HMO 39.4%

- Blue Advantage Plus POS 38.4%

Changes in allowable rating factors, such as age, geographical area, or tobacco use, may also impact the premium amount for the coverage.

There are currently 1,082,299 members on Individual Affordable Care Act (ACA) plans that may be affected by these proposed rates.

Financial Experience of the Product

Consistent with the filed URRT, earned premiums for all non-grandfathered Individual plans during calendar year 2024 were $8,880,222,618 and total claims incurred were $8,024,675,520. The proposed rates effective January 1, 2026 are expected to achieve the loss ratio assumed in the rate development.

Changes in Medical Service Costs

The proposed rates reflect expected change in year over year medical service and prescription drug costs, which includes changes in reimbursement rates to providers, changes in expected utilization of services, the mix and intensity of services, and the introduction of new procedures and technologies.

Changes in Benefits

There are no legally required changes to covered benefits and no significant changes to the benefit structure. Cost-sharing changes were made within these products allowing plans to maintain their metal status, which can contribute to the change in rates.

Celtic Insurance Co

The proposed rate change of 41.5% applies to approximately 487,491 individuals. Celtic Insurance Company’s projected administrative expenses for 2026 are $82.92 PMPM. Administrative expense does not include $39.01 for taxes and fees. The historical administrative expenses for 2025 were $75.61 PMPM, which excludes taxes and fees. The projected loss ratio is 85.2% which satisfies the federal minimum loss ratio requirement of 80.0%.

CHRISTUS Health Plan

(CHRISTUS didn't provide the actual current enrollment total, but I did find the following in the objection/response section of their filing, which I used to extrapolate the total enrollment figure):

Response 1

Comments: After analyzing the enrollment template and the members that were outside of our service area, we found that 0.9% (537) members were in counties that have split counties based on the members zip code. There are another 0.05% (27) members that we are still investigating to confirm the detail. We would like to discuss the details and the reconciliation of these members tomorrow when we meet on the rates.

Based on this I estimate CHRISTUS to have roughly 60,000 enrollees.

Cigna Healthcare of TX

2. SCOPE AND RANGE OF RATE INCREASE

Cigna estimates that 23,396 customers will be impacted by this rate increase. On average, customers will see an increase of 42.3%, excluding the impact of aging, with a range of increases from 23.0% to 56.5%. In addition to the factors described below, each customer’s rate increase depends on factors such as where they live and what plan they are enrolled in.

3. SIGNIFICANT FACTORS

The most significant factors causing the rate increase are:

- Expiration of APTC Subsidies: This rate filing assumes that APTC subsidies will expire on 12/31/2025. The conclusion of the enhanced subsidies is expected to lower enrollment and increase morbidity.

- Changes in Medical Service Costs: The increasing cost of medical and pharmacy services and supplies accounts for a sizeable portion of the premium rate increases. Cigna anticipates that the cost of medical and pharmacy services and supplies in 2026 will increase over the 2024 level because the prices charged by doctors, hospitals, and other providers are increasing. Additionally, the more frequent use of medical services by customers also increases Cigna's costs. The recent increase in Consumer Price Index (CPI) inflation is adding additional inflationary pressure for network contracts and provider payment mechanisms.

- Changes for the healthiness of the population: The health exchanges for individual plans continue to evolve, following the introduction of the Patient Protection and Affordable Care Act. The overall health of the population is significantly impacted by changes in:

- enrollment decreases from year to year, as this tends to increase the average healthcare cost of the remaining market enrollees

- anticipated changes to regulations regarding things like Short Term Medical and Association Health Plans that will impact the Affordable Care Act population are likely to attract healthier consumers away from the individual market, which increases the average healthcare cost per customer

- Plan design changes and benefit modifications: Changes have been made to plans that are resulting in an increase in expected cost share and therefore an increase to premium. All plan designs conform to actuarial value and essential health benefit requirements.

Community First Insurance Plans

This submission is for individual health insurance products offered by Community First Insurance Plans (CFIP) in the Texas individual market, available for sale January 1, 2026. CFIP is increasing premium rates for individual plans by 17.58% in aggregate, with a minimum of 12.28% and a maximum of 18.77%. As of March 2025, there are 3,729 members who are affected by this rate filing if they were to purchase the same plan in 2026.

...Changes in Medical Service Costs

Components of the rate increase include normal secular medical and prescription drug inflation, expected changes in the quantity and type of services used, changes to the morbidity levels of 2026 enrollees, and estimated risk adjustment transfer amount for 2026.

4. Changes in Benefits

Benefit design changes were made to a number of cost-sharing parameters, including updating maximum out-of-pockets and other copay levels to meet the de minimis criteria in the HHS AV Calculator, and to reflect the 2026 federal standardized plan designs. The majority of these changes were prescribed by the Center for Consumer Information and Insurance Oversight (CCIIO) via Standard plan designs.

5. Administrative Costs and Anticipated Margins

Administrative costs are based on the 2026 business plan and were not a primary driver of the rate increase, as they are consistent with 2025 pricing.

Community Health Choice TX

(Actuarial memo heavily redacted)

Community Health Choice

(Actuarial memo heavily redacted)

Imperial Insurance Co

(Actuarial memo heavily redacted)

Moda Health Plan

The average rate change is 14.74%. The maximum is 18.71%, and the minimum is 10.43%. The number of individuals impacted by this rate change is 4,436.

Most Significant Factors

Moda Health Plan’s 2024 Texas Individual experience was used to develop 2026 rates. This experience was determined to be 91.13% credible based on having 53,950 member months in the experience period and needing 65,000 members to be fully credible. The most significant factor contributing to the increase is Moda Health Plan’s Texas Individual experience and an 8.0% annual trend. The other significant factor contributing to the increase is the manual rate component. Moda Health Plan’s 2024 Oregon Individual experience trended forward to the 2026 rating period and adjusted to an Idaho cost basis was used to develop the manual rate. Other factors impacting the overall rate change are changes in risk adjustment and silver loading assumptions.

Molina Healthcare of TX

Molina Healthcare of Texas, Inc. is a managed care organization that provides healthcare services for individuals eligible for Medicaid, Medicare, and Marketplace throughout the State of Texas. Molina Healthcare of Texas, Inc. is a licensed state health plan managed by its parent corporation, Molina Healthcare, Inc.

1. Scope and range of the rate increase: Molina’s proposed rates represent an average rate change of 29.3% for the 63,697 Molina members enrolled in continuing plans effective March 2025. The proposed rate changes vary by metal tier. Members would receive premium changes ranging from -4.9% to 31.6% depending on their plan, geographic location, and age.

2. Financial experience of the product: The proposed premium rates yield a medical loss ratio of 80.7%. The medical loss ratio represents the percentage of every premium dollar that Molina expects to spend on medical expenses and improving health care quality for our members. The projected medical loss ratio of 80.7% exceeds the Affordable Care Act minimum required loss ratio of 80.0%.

3. Changes in Medical Service Costs: Medical inflation related to the utilization and cost of covered services increased claims by 6.6%. Trend is one of the primary contributors to an increase in rates. Changes in provider contracting rates also contributes to the regional rate

changes.

Oscar Insurance Co

1. Scope and Range of Rate Increase

The purpose of this document is to present rate change justification for Oscar Health Plan of Pennsylvania, Inc (Oscar’s) Individual Affordable Care Act (ACA) products, with an effective date of January 1, 2026, and to comply with the requirements of Section 2794 of the Public Health Service Act as added by Section 1003 of the Patient Protection and Affordable Care Act (ACA).

Using in-force business as of June 2025, the proposed average rate increase for renewing plans is 26.1%. Rate increases vary by plan due to a combination of factors including shifts in benefit leveraging and cost-sharing modifications. This rate increase is absent of rate changes due to attained age.

The rate increase impacts an estimated 265,713 members.

2. Reason for Rate Increase(s)

The significant factors driving the proposed rate change include the following:

Medical & Prescription Drug Inflation & Utilization Trends

The projected premium rates reflect the most recent emerging experience which was trended for anticipated changes due to medical and prescription drug inflation and utilization.

Administrative Expenses, Taxes & Fees, and Risk Margin

Changes to the overall premium level are needed because of required changes in federal and state taxes and fees. In addition, there are anticipated changes in both administrative expenses and targeted risk margin.

Prospective Benefit Changes

Plan benefits have been revised as a result of changes in the Center for Medicare and Medicaid Services (CMS) Actuarial Value Calculator and state requirements, as well as for strategic product considerations.

Anticipated Changes in the Average Morbidity of the Covered Population

Changes to the overall premium level are needed because of anticipated changes in the underlying morbidity of the projected marketplace.

Anticipated Changes in the Network Configuration

Changes to the overall premium level are needed because of anticipated changes in the underlying networkconfiguration and associated unit costs.

Sendero Health Plans

The proposed overall rate change for the Individual plans offered by Sendero Health Plans, Inc. (Sendero) both on and off the marketplace is 16.2 percent based on the current enrollment renewing into the plans available for 2026. The average increase varies by plan, ranging from 8.7 percent to 19.4 percent. A subscriber’s actual rate increase could differ depending on the plan, geographical location, age characteristics, dependent coverage, and other factors.

...Changes in Medical Service Costs

There are numerous healthcare cost trends that contribute to increase in the overall spend each year. The trend factors bear weight on health insurance premiums, which could constitute a premium rate increase to cover costs. Key trends that have affected this year’s rate action include:

- Increased medical costs – reimbursement rate increases to hospitals and providers

- Pharmacy utilization and expense – price increases and a shift to high-cost specialty drugs

Superior Health Plan (Ambetter)

The proposed rate change of 36.0% applies to approximately 475,005 individuals. Superior Health Plan’s projected administrative expenses for 2026 are $80.07 PMPM. Administrative expense does not include $29.26 for taxes and fees. The historical administrative expenses for 2025 were $72.77 PMPM, which excludes taxes and fees. The projected loss ratio is 86.1% which satisfies the federal minimum loss ratio requirement of 80.0%.

UnitedHealthcare of TX

UHCTX is filing 2026 rates for individual products. The proposed rate change is 23.02% and will affect 580,871 individuals. The rate changes vary between 13.5% and 31.1%. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

...Changes in Medical Service Costs

There are many different healthcare cost trends that contribute to increases in the overall U.S. healthcare spending each year. These trend factors affect health insurance premiums, which can mean a premium rate increase to cover costs. Some of the key healthcare cost trends that have affected this year’s rate actions include:

- Increasing cost of medical services: Annual increases in reimbursement rates to healthcare providers, such as hospitals, doctors, and pharmaceutical companies.

- Increased utilization: The number of office visits and other services continues to grow. In addition, total healthcare spending will vary by the intensity of care and use of different types of health services. The price of care can be affected using expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher costs from deductible leveraging: Healthcare costs continue to rise every year. If deductibles and copayments remain the same, a higher percentage of healthcare costs need to be covered by health insurance premiums each year.

- Impact of new technology: Improvements to medical technology and clinical practice often result in the use of more expensive services, leading to increased healthcare

- spending and utilization.

- Expiration of enhanced premium tax credits: Expanded and enhanced federal premium tax credits for consumers will expire at the end of 2025. As a result, post-tax credit premiums will increase for calendar year 2026.

- • Changes in market morbidity: Premiums reflect the expected increase in the average cost per member due to healthier members leaving the market if enhanced ATPCs are allowed to expire.

Wellpoint Insurance Co

Table 1 summarizes the significant factors driving the proposed composite rate change effective January 1, 2026. The manual rate claims costs were increased for anticipated changes due to medical / prescription drug inflation and increased medical / prescription drug utilization. We also updated certain factors used in the calibration of the multi-state manual rate experience to align with expectations for the Texas individual market. The manual morbidity factor increased primarily due to the expectation of worsened morbidity in the market coinciding with the assumed expiration of enhanced premium tax credits in 2026. The manual geographic factor increased due to revised expectations in Wellpoint’s utilization and unit costs in Texas relative to the manual experience.

Similar to the 2025 rate filing, we projected average statewide premiums for 2026 and assumed a risk adjustment payable that aligns with the underlying morbidity assumption utilized in the claims projections. This led to a similar, but slightly lower projected risk adjustment payable as a percent of premium compared to the 2025 rate filing. We also reflect Wellpoint’s latest administrative expense assumptions.

Table 2 shows rate increases by plan along with current rates and enrollment as of March 31, 2025. The minimum rate increase requested is 16.2% and the maximum rate increase requested is 32.0%.

The good news is that I've been able to lock in actual current enrollment figures for 14 of the 19 total carriers (18 next year, as Aetna is dropping out; CHRISTUS may or may not be). In the case of CHRISTUS I had to extrapolate an estimate based on an obscure question in the filing; in the case of Sendero, I'm basing the number of enrollees on extrapolating out the number of policyholders noted in the filing.

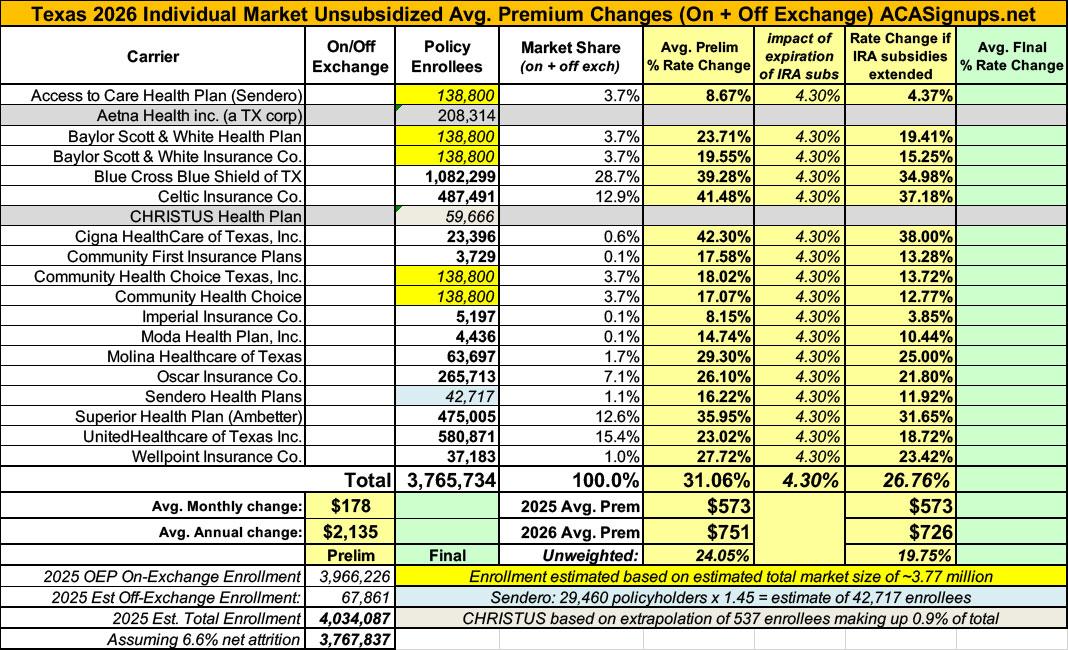

The bad news is that there's still 5 carriers (Access to Care, the 2 Scott & White divisions and 2 of the Community Health Choice divisions) where I don't know their actual current enrollment numbers. There's around ~700,000 enrollees unaccounted for, so if I divide that evenly across these 5, I get ~138,800 apiece, give or take. This isn't ideal, but it's the best I can do.

With this in mind, I get a semi-weighted average preliminary rate increase of 31.1% statewide across the Texas individual market.

HOWEVER, it's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

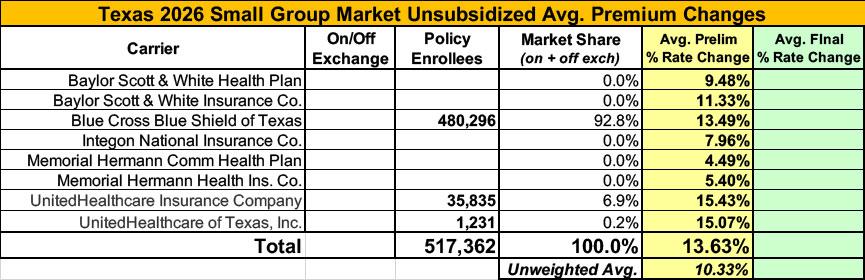

Meanwhile, I have no enrollment data at all for most of the small group carriers; the unweighted average 2026 rate hike there is 10.3%.

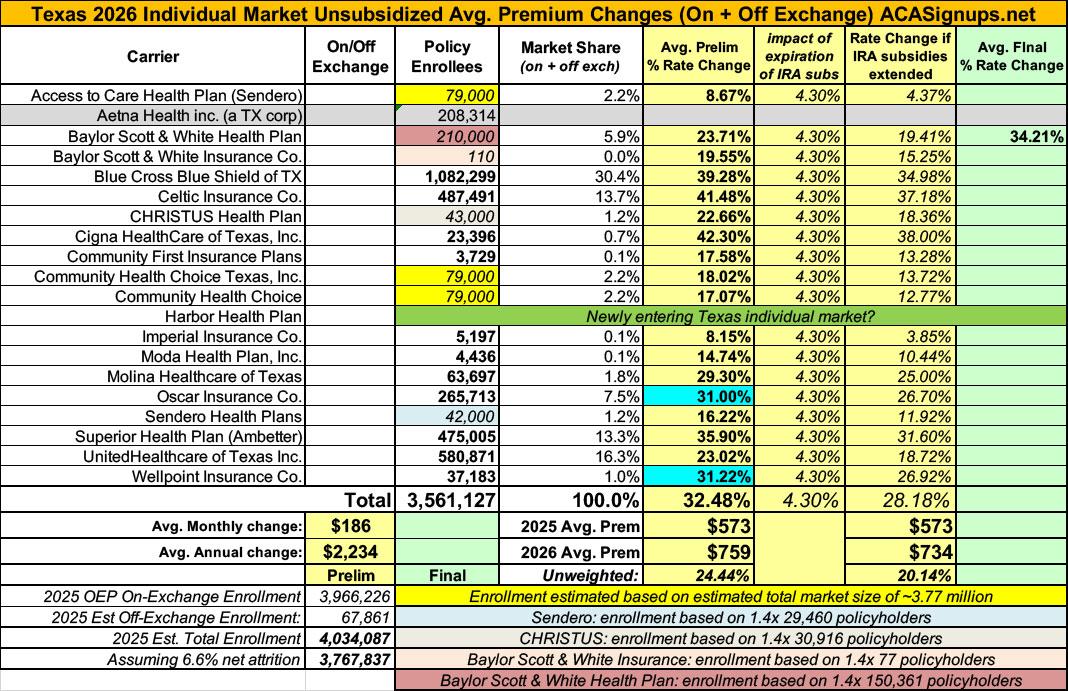

UPDATE 8/29/25: OK, I've been able to better fill in some of the gaps via some more recent filing forms (see PDFs below; the ones marked "2" at the end) which include hard enrollment numbers for some carriers & policyholders for some others. Using a rough estimate of 1.4 covered lives per policy allows me to get a better idea of the enrollment numbers for a few more carriers.

In addition, a couple of carriers have revised preliminary filings, and one even has an approved rate change.

The end result of these updates is that the weighted average increases slightly more, from 31.1% to 32.5%.

Also, it turns out CHRISTUS is not dropping out of the TX individual market after all; I've filled in their numbers as well.

Also, it looks like "Harbor Health Plan" is newly entering the TX Individual market.

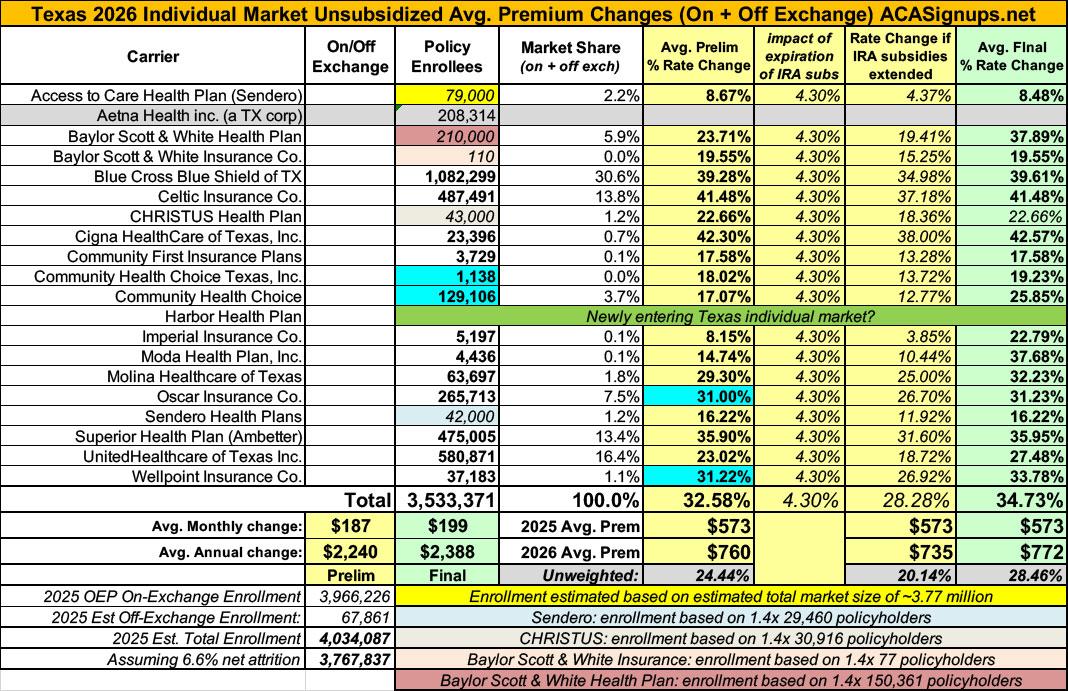

UPDATE 11/02/25: Just hours ahead of Open Enrollment launching, Texas insurance carriers had their final, approved rate filing decisions published to the federal rate review database. In addition to several significant changes to carrier filing averages, I was also able to get the actual enrollment data for two more carriers. Overall, the weighted average rate increase moved up by over two points to +34.7%.